Sweden’s Economy Keeps Shrinking for a Fourth Straight Quarter

Sweden’s economy posted a fourth consecutive quarter of contraction as interest-rate cuts that could spur activity in the largest Nordic nation are yet to materialize.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sweden’s economy posted a fourth consecutive quarter of contraction as interest-rate cuts that could spur activity in the largest Nordic nation are yet to materialize.

Message to bond underwriters: Some big customers are sizing up your ESG credentials.

Greater China’s property market crisis and the challenges it poses for lenders will be on full display on Monday, when embattled developer China Vanke Co. and the region’s biggest banks report earnings.

Hong Kong’s benchmark equity index headed for a technical bull market as a surge in Chinese property shares gave more impetus to this month’s stellar rebound.

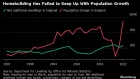

Britain’s homebuilding approval process is failing to cope with a surge in local protectionism that’s driving more costs to the taxpayer

Jun 25, 2020

I love real estate. I love to buy, I love to sell – and moving thrills me. It always feels like a new beginning.

Real estate has proven to be a great investment over the years with capital gains on our principle property exempt. And while there are costs with buying and selling such as land transfer, legal and real estate fees – to mention a few – even after factoring in these numbers we have come out further ahead financially.

It's felt like the real estate market has had one trajectory: Up. However, given the economy has come to a standstill as we try to work our way through a pandemic, the fear is the housing market will correct or reverse course, which is forcing many to the sidelines.

The Canada Mortgage and Housing Corporation (CMHC) expects to see a pullback in prices anywhere from eight to 18 per cent this year. Add to this, the new CMHC borrowing guidelines are kicking into gear July 1, which include increasing the credit score qualifying threshold from 600 to 680 and limiting gross and total debt servicing ratios to their standards of 35 per cent and 42 per cent, respectively. And where is gets even more complicated, CMHC will also no longer treat non-traditional sources of down payment sources, such as unsecured lines of credit, as equity for insurance purposes.

The new rules will prove to be challenging for those who were pre-approved prior to the pandemic, when income and employment income may have been very different. If things have changed even temporarily, it’s unlikely you will be able to get a mortgage at a mainstream lender like a bank. In fact, those who may have inconsistent income levels that have been interrupted due to the pandemic are likely going to find it tough to secure cost effective funding.

I reached out to Rob McLister, founder of mortgage comparison website ratespy.com, and asked: Will people still qualify if their pre-approval has expired and they are getting ready to close on a pre-construction project while collecting CERB? Will collecting the CERB compromise your chance of getting a mortgage?

His response: “The reality is, if your mortgage approval depends on the income that CERB replaced, you could be forced to seek higher-cost financing. That's a big problem if your down payment is small (i.e. less than 20 per cent) because higher-cost lenders require ample equity to offset their risk.

If you have a big enough down payment (e.g., 25-50 per cent) you can sometimes find private or alternative lenders who don't ask questions about your income. But you're not going to like their rates and fees.

In limited cases, larger non-prime lenders may approve mortgage applicants presently on CERB if the applicant has:

1. A confirmed return-to-work date before the mortgage closing date

2. Employment in the same job for at least a few years

3. A job that is reasonably expected to remain stable after they return to work

4. Liquid fallback assets to pay the mortgage if they get laid off again.”

But these are exceptions, not a rule. And non-prime rates and fees can be unpleasant.

The bottom line is new mortgage lending rules and a pandemic that may have compromised your income is going to force new home buyers to sit on the sidelines for longer as they save up more.

Unfortunately, given the landscape, lenders are protecting themselves in the event more layoffs happen should a second wave occur. No one wants to repossess a home when mortgage payments can't be made.