Aug 3, 2023

PBOC Pledges More Financial Resources for Private Firms

, Bloomberg News

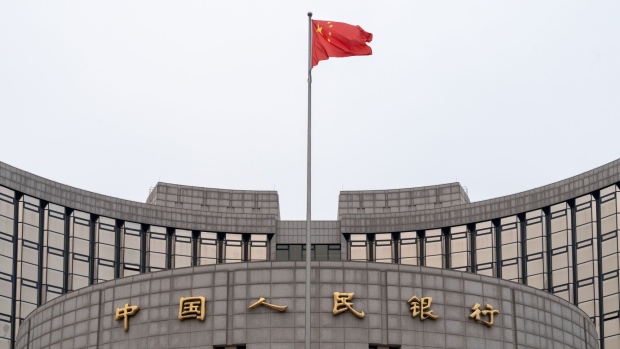

(Bloomberg) -- China’s central bank said it would increase funding support for the private sector after meeting with executives from the property industry, identifying several companies by name in a statement that underscores growing urgency among regulators to boost market confidence.

Newly appointed People’s Bank of China Governor Pan Gongsheng met with representatives from eight private firms, including developers Longfor Group Holdings Ltd., CIFI Holdings Group Co. and Midea Real Estate Holding Ltd. to hear about their difficulties and corporate financing needs, the PBOC said in a statement on Thursday. Banks like Industrial and Commercial Bank of China Ltd. were present as well.

The meeting is the latest in a series of attempts by regulators across China’s government to shore up the private sector as the country’s economic recovery sputters and stress in some corners of the bond market increases. Reviving the property market would be key to boosting growth, with the Communist Party’s Politburo last week signaling a shift toward looser policies for the sector.

Zhang Zhiwei, chief economist at Pinpoint Asset Management Ltd., said the message from top officials is to support the housing market, although it’s unclear if any new measures are coming.

“Under-stressed sectors require more financial help, and that’s the property sector, which is clear,” said Zhang.

Chinese high-yield dollar bonds gained about 1 cent Friday morning, according to credit traders, after dropping earlier this week. The strongest-performing developer was investment-grade rated Longfor, whose 3.375% bond due 2027 jumped 3.5 cents to 73.9 cents, set for the largest advance in over a week.

Pan said the central bank will expand a support tool for private companies’ bond issuance and meet the reasonable financing needs of developers to foster the healthy development of the housing market. Last year, China’s financial regulators widened a bond financing program to about 250 billion yuan ($34.9 billion) for private companies including developers. The PBOC didn’t provide details on what the latest changes would entail.

Zerlina Zeng, a senior credit analyst at CreditSights, said the meeting echoed the Politburo’s dovish tone “but fell short of new funding support measures for the property and private sectors.” Confidence among private developers and appetite for borrowing, investing, or hiring won’t be meaningfully restored “until the policymakers come up with a more predictable, rule-based, and well-communicated regulatory framework for the sector,” she said.

Other businesses that were present at the meeting included dairy producer Inner Mongolia Yili Industrial Group Co. and aluminum maker China Hongqiao Group Ltd.

While supportive statements like the PBOC’s have helped buoy markets somewhat, skepticism remains elevated among investors and company executives burned by years of unpredictable policy shifts.

Sentiment in China’s property sector has been particularly fragile, with bonds of real estate companies including Country Garden Holdings Co., Dalian Wanda Group and Sino-Ocean Group Holding Ltd. coming under pressure in recent weeks. The three companies weren’t among those mentioned by the PBOC.

“Developers have had some refinancing troubles again recently,” said Ding Shuang, chief economist for Greater China and North Asia at Standard Chartered Plc. “Support will be targeted toward high-quality companies.”

Wilfred Wee, a portfolio manager at Ninety One Singapore Pte Ltd., said it was good to see representation of the major players at the PBOC meeting.

“The first step to policy recalibration is recognizing the reality of key stakeholders,” he said. “For the sector to then rebound with some rigor, the ball is now in the court of regulators to provide real reprieve.”

Officials from the PBOC, National Development and Reform Commission and the Ministry of Finance, held a briefing on Friday, reiterating support for the economy. The PBOC will step up “counter-cyclical” measures and use existing and new policy tools when necessary, said Zou Lan, head of the monetary policy department. The NDRC will study and plan more targeted and forceful policies, while the Ministry of Finance will step up tax breaks for smaller firms, the officials said.

The NDRC and other government departments have issued almost daily statements of support for the economy since the Communist Party’s Politburo — the 24-member policymaking body led by President Xi Jinping — met last week and pledged to boost market confidence.

Beijing has stopped short of announcing any major monetary or fiscal stimulus, though, with economists saying financial support this year will be smaller than during previous easing cycles.

“The main problem now remains subdued confidence,” said Standard Chartered’s Ding. “Credit supply has been very fast already, but if there’s no demand, the policies won’t be effective.”

The Politburo also signaled more policy action to reduce local government debt, which is holding back investment and growth in many provinces. China Securities Journal said in a front-page report on Friday that officials are expected to speed up a plan to tackle the debt problem, with possible measures including debt swaps, extensions and restructuring.

More property easing steps are also on the cards. China’s top housing official, Ni Hong, recently called for stronger efforts to revive the ailing sector, including allowing homebuyers who had paid off previous mortgages to be considered as first-time purchases.

China also plans to scrap restrictions on household registration in cities with urban populations of less than 3 million in an effort to boost economic development, the state-owned Global Times reported, citing Ministry of Public Security official Qi Xiguo at briefing on Thursday. Such a move would likely provide support for local housing markets.

--With assistance from Phila Siu, Yujing Liu, Fran Wang, Lorretta Chen, Dorothy Ma, Evelyn Yu and Foster Wong.

(Updates with additional details.)

©2023 Bloomberg L.P.