Oct 13, 2022

Pensions Chaos Deepens Fears Over UK Shadow Banking Risks

, Bloomberg News

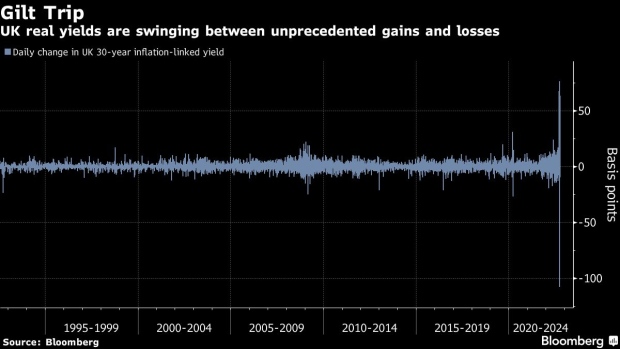

(Bloomberg) -- With uncanny timing, the Bank of England’s quarterly review of the risks facing the banking system landed during a fresh bout of market panic.

Wednesday morning’s financial policy summary expressed confidence in the resilience of traditional banks to weather a downturn. Of greater concern was the shadow banking system, the industry of lenders, brokers and other intermediaries that fall outside the realm of traditional regulated banks.

“The vulnerabilities exposed by the gilt market dysfunction share characteristics with those in the non-bank financial system,” the central bank’s report said. It is crucial to boost “the resilience of non-bank financial institutions globally to sharp reductions in asset prices and liquidity.”

Such concerns echoed Governor Andrew Bailey’s call in a speech Tuesday for tougher standards for the non-bank financial sector, which made up about half of all global financial assets -- some $227 trillion -- in 2020, the Financial Stability Board said in a report in December.

Regulators have worried about this opaque market for years but such fears have sharpened over the past couple of weeks after the UK government announced a package of unfunded tax cuts. That caused chaos in a little-known corner of the pensions market as funds dumped government and corporate bonds to cover their derivative positions.

Read More: How ‘Liability-Driven’ Funds Triggered UK Bond Panic: QuickTake

With the Bank of England seemingly determined to end its emergency bond-buying program on Friday, the turmoil is unlikely to ease. That could spill over into the wider shadow banking system already hurting from higher interest rates.

Former UK Prime Minister Gordon Brown told the BBC last week that more trouble lies ahead.

“As inflation hits and interest rates rise, there will be a number of companies, a number of organizations that will be in grave difficulty, so I don’t think this crisis is over because the pension funds have been rescued,” he said. “There’s got to be eternal vigilance about what has happened to what is called the shadow banking sector, and I do fear that there could be further crises to come.”

Shadow Banking

Shadow banking is a catchall phrase that encompasses hedge funds, risky investment products, pawnshop and loan-shark operations and so-called peer-to-peer lending between individuals and businesses. The common denominator is that these products and practices flourish outside the regular banking system and often beyond the reach of regulators.

Critically, they raise short-term funds and buy assets with longer-term maturities. The mismatch was a source of concern well before the mini-budget, drawing the attention of regulators worldwide. The Financial Stability Board said in a review last year that the market mayhem at the start of the pandemic in March 2020 had highlighted vulnerabilities in the sector, and exposed the interconnectedness of shadow banks and traditional lenders.

Read More: Shadow Banking Is Booming Outside Regulators’ Grip: QuickTake

At the heart of the turmoil this time have been a little-watched cornerstone of UK pension funds, which manage more than $1 trillion in assets. These funds have offloaded all kinds of holdings in recent weeks to meet margin calls on derivatives they used to help ensure they have enough money to pay retirees decades in the future.

The UK pension industry has operated through years of declining interest rates but rising rates are now the new normal, said Scott Peng, founder and CEO of Advocate Capital Management LLC. That has left the industry blindsided to the impact of tighter monetary policy. “This is the first time in over a decade that the UK LDI risk management framework has really been stress-tested and it did quite poorly,” he said. “This should result in a serious review of pension risk and liquidity management.”

Multi-asset funds too are also a casualty of the pension industry’s dash for cash. Funds run by major asset managers, including Aviva Plc and Schroders Plc, have recorded hundreds of millions of pounds in net outflows since Sept. 23, when the UK government announced a package of unfunded tax cuts that sent the price of gilts tumbling.

Other entities or asset classes that rely on leverage may also find themselves in the spotlight, according to Howard Davies, chairman of NatWest Group Plc and former deputy governor of the central bank. Investment funds, hedge funds and private equity have all spent years in a world of low interest rates and the adjustment to higher rates could set off turbulence.

Property, Cars

The travails in the shadow banking world may spill out into the wider economy, given shadow banking firms now play significant roles in markets from real estate to car finance.

“Just as you’ve seen some marginal players in the mortgage markets pulling out because their wholesale funding isn’t available, I think you’re going to see that in other parts of shadow banking,” Davies said on Bloomberg Television Wednesday. He said he’d pay particular attention on those areas that are dependent on short-term funding.

That might include home loan providers outside of the traditional banks, a blow to an already squeezed housing market that’s seen mortgage costs spike, products pulled and caused some house sales to collapse.

Still, history suggests it will be difficult to predict where the crunch will come from.

“It’s the pattern of all financial crises for hundreds of years,” Charlie Parker, managing director at boutique investment manager Albemarle Street Partners, said. “It’s always the bit of the market you’re least focused on.”

©2022 Bloomberg L.P.