Oct 26, 2023

Private Credit Lenders Giving Up Protections to Win Bigger Deals

, Bloomberg News

(Bloomberg) -- Private credit firms seeking to capture market share from traditional bank lenders are giving up investor protections as they snag larger financings, according to Moody’s Investors Service.

Direct lenders have been siphoning business from the broadly-syndicated leveraged loan market in recent years, in part by staking a claim to increasingly larger deals. But an analysis by the credit-rating firm shows that legal safeguards that protect investors tend to weaken as the size of the transactions increase.

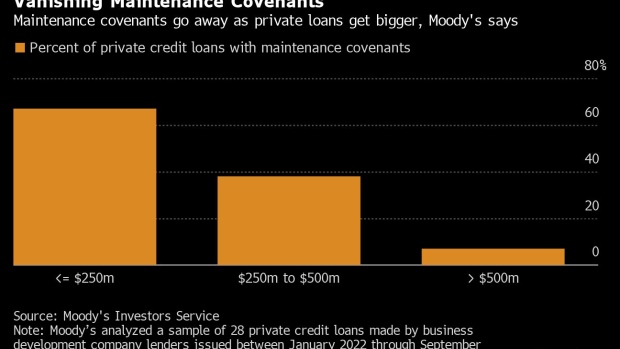

“Private credit is dropping maintenance covenants in larger deals,” analysts including Derek Gluckman wrote in a Thursday report, referring to a type of investor protection that requires companies to periodically meet certain tests of financial health. Leveraged loans discarded the safeguards years ago and most are now considered ‘covenant-lite.’ Direct lenders are following suit, Moody’s says, noting that only 7% of private credit loans larger than $500 million in its analysis had maintenance covenants, compared to 67% of loans smaller than $250 million.

Moody’s has already written that the competition between banks and direct lenders in the leveraged buyout arena will likely result in more defaults as riskier debt deals get done, part of a “race to the bottom” between the two groups as they compete for a limited number of financings. Weaker protections suggest private credit firms could be in store for more pain than previously expected should their loans sour.

Leveraged loans have historically been arranged by banks and then sold to large groups of institutional asset managers, who can trade them in a secondary market. Private credit firms instead provide the debt themselves and hold on to it until maturity.

The global $1.5 trillion private credit market has been known for more conservative deal terms that give lenders increased control over the debt and the company if things go wrong, whereas the competition of numerous lenders trying to get into the same deals has led covenants to erode over time in the broadly-syndicated market.

“Private credit loans are strikingly more protective than broadly-syndicated loans, but differences will narrow,” Moody’s wrote. “The ramparts between public and private lenders will come down as competitive pressures mount, just as the same protections eroded in the broadly-syndicated loan market over time.”

One bright spot for direct lenders is that their loans had significantly more protections against controversial liability management deals that typically improve a borrower’s financial position by moving assets and pitting different groups of lenders against each other — such as in so-called “dropdown” or “uptiering” transactions.

For example, all private credit loans examined by Moody’s, regardless of size, prohibited the transfer of intellectual property to unrestricted subsidiaries, whereas only two-thirds of broadly-syndicated leveraged included the protection.

Read More: Credit-Market Clashes Are Getting Uglier, Dirtier, More Common

Moody’s analyzed a sample of 28 private credit loans made by business development companies — a popular investment vehicle used by private credit managers — from January 2022 through September 2023, and compared those to a sample of 15 broadly-syndicated leveraged loans over the same time period.

Deals

- Sycamore Partners is in talks with private credit firms to arrange as much as $300 million in financing for its $1 billion acquisition of apparel retailer Chico’s FAS Inc.

- Ares Management Corp. is leading a new preferred equity investment into Consolidated Precision Products, an aerospace parts manufacturer owned by private equity firm Warburg Pincus

- Associated Asphalt is exploring options to address its upcoming debt maturity, including getting new financing from private lenders

- Bank of Montreal is exploring the sale of a portfolio of recreational vehicle loans with a face value of at least $5 billion

- KKR & Co. has reached a deal with a group of private credit lenders led by Blue Owl Capital Inc. that will help it recapitalize its portfolio company PetVet Care Centers

- Blackstone Inc. is leading a $400 million private credit loan to New York-based hospitality and hotel management company Highgate to refinance existing debt

- Apollo Global Management Inc. has agreed to provide Redfin with as much as $250 million in the form of a first-lien term loan facility

- Direct lending funds are working to provide about €250 million of private debt to back a potential buyout of construction software maker Sogelink

- Private credit firms are working on a debt package of more than £400 million to support private equity bidders considering acquiring Stirling Square’s Outcomes First Group business

Fundraising

- Fortress Investment Group is targeting as much as $8 billion for its latest credit opportunities fund, which will invest in areas ranging from distressed debt to structured credit

- Pictet Asset Management’s debut direct lending fund raised €200 million in its first close

- Bain Capital Special Situations has partnered with Smith Hill Capital to launch a private lending platform focused on the hospitality sector

- Oak Hill Advisors raised $2.3 billion of equity commitments for the third vintage of its flagship distressed investment fund

Job Moves

- Australia’s private debt specialist Revolution Asset Management has hired Pratik Joshi in Sydney as a portfolio manager

- Polen Capital has hired Gus Phelps to help steer the asset-management firm’s direct investments in private middle-market companies

- Antares Capital added three executives to its New York-based liquid credit team, as the firm primarily known for direct lending looks to expand in the space

- Federated Hermes has appointed Damien Hedderwick as a director in its private credit team, working on European and UK direct lending strategies

- Ares Management Corp. has hired Will Farrant and Ruby Lau to join its newly established asset-backed lending team for Australia and New Zealand

Did You Miss?

- The Shrinking $1.3 Trillion CLO Market Is Bad News for Bankers

- Blue Owl Is Said to Weigh Acquisition of European Lender Hayfin

- Adevinta Shows How Far Private Lenders Will Go to Win Deals

- Private Credit Boom May Reopen Old Wounds: India Edition

©2023 Bloomberg L.P.