Nov 4, 2022

Pro Traders and Algorithms Have Overrun the Fast-Twitch Option Market

, Bloomberg News

(Bloomberg) -- While it might look like a reprise of meme-era excess, the 2022 boom in very-short-lived index options is more than a retail phenomenon.

So say JPMorgan Chase & Co. strategists including Peng Cheng, whose team studied public trading data and found that small-fry investors can’t be responsible for the explosion of S&P 500 contracts that mature within 24 hours, a category known as zero day to expiry, or 0DTE.

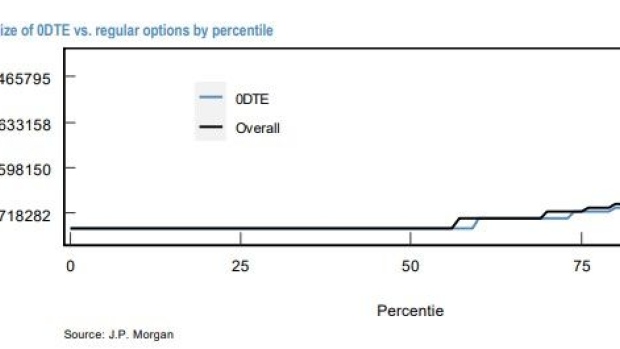

The assumption that this particular trading frenzy was the province of retail day traders has been fueled by the prevalence of small-size transactions, typically associated with the retail crowd, Peng says. More likely it’s computer-powered institutions breaking down big orders into small ones to cloak their strategies, he says.

“It is tempting to overestimate the retail activity in 0DTE options, given one observes a large number of small trades,” Cheng wrote in a note to clients Thursday. However, “due to the proliferation of algo trading, trade size is no longer a good classifier for retail vs. institutional.”

By the team’s estimate, about 5.6% of all volume in such short-dated options in the past month can be attributed to retail market orders. While that’s higher than the average for all the index’s options trading, it’s obviously not the dominant flow. Moreover, the distribution of 0DTE option trade sizes are largely identical to regular ones.

The research adds empirical evidence to the claim from strategists at firms like Nomura Securities International Inc. and RBC Capital Markets that institutional investors are driving the recent boom in these fast-trigger, high-risk options trades.

During the third quarter, S&P 500 options expiring within one day accounted for more than 40% of total volume, almost doubling from six months ago, according to data compiled by Goldman Sachs Group Inc.

Some market watchers attributed the rush to the need among defensively positioned money managers to catch up to the market rally by purchasing bullish call options. Others suggest institutions are flocking to the products to manage portfolio risk when intraday reversals have become a signature feature of 2022’s market.

Whatever the reason, these contracts have seen holders go in and out in a flash. Only about 6% of these options were kept open until maturity, JPMorgan data show.

What does it mean for the market? While not unanimously accepted, one narrative holds that the explosion in options trading causes derivatives to amplify moves in underlying assets, potentially creating market dislocations.

The group at the center of it all is options dealers, who take the other side of the trade and must buy and sell stocks to keep a market-neutral stance. The theoretical value of stock required for market makers to hedge the directional exposure resulting from all options activity is known as delta.

Breaking all 0DTE options trades into five-minutes intervals, Cheng and his colleagues then plotted their deltas at trade imitation against the S&P 500’s performance. In short, the team found that over the past month, the market impact from those trades can vary from a drag of as much as 0.6% to a boost of up to 1.1%.

“There is indeed some market impact on the SPX from 0DTE delta,” the team wrote.

©2022 Bloomberg L.P.