Apr 12, 2023

Shopify stock jumps after gaining one more Wall Street bull

, Bloomberg News

Don't chase an expensive company like Shopify, where the growth is slowing down: John Zechner

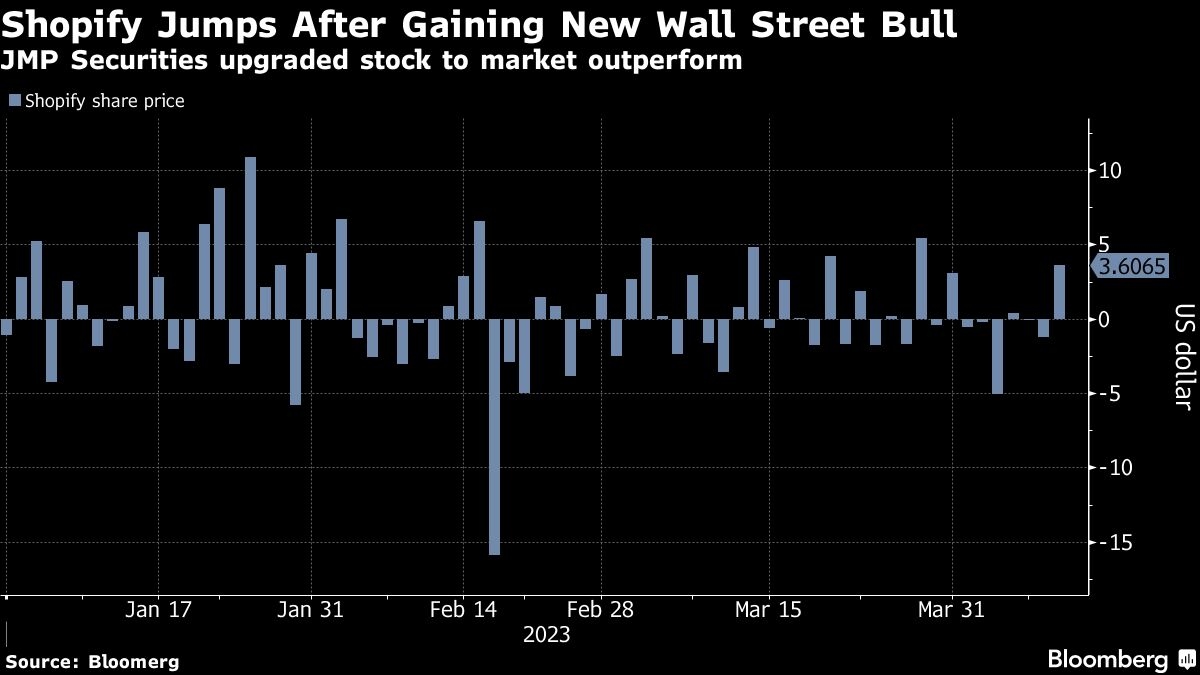

Shopify shares rose 1.2 per cent Wednesday, paring some gains from earlier in the day, after winning over one more analyst.

JMP Securities upgraded the e-commerce company to market outperform from market perform and set a US$65 price target. The target implies a 45 per cent upside from where the stock closed Tuesday at nearly US$45 per share.

Wall Street has been mostly middle-of-the-road when it comes to Shopify. More than half of the analysts covering the company have a hold-equivalent rating on the stock, while about 39 per cent say buy, according to data compiled by Bloomberg. The stock increased nearly 10-fold from 2019 to 2021, then shed nearly 75 per cent in 2022. It has been struggling to regain those losses this year, shares are up about 31 per cent so far.

“Shopify is the leader in commerce enablement and continues to take share,” JMP Securities analyst Andrew Boone wrote in a note Wednesday, adding that “there is room for greater” costs cutting.

Of course, Shopify like its peers face macroeconomic risks with a potential recession looming that could hit consumer spending, Boone wrote.

The company is also in an investment cycle with its fulfillment network, SFN (Shopify Fulfillment Network), but the size of the investment is less than expected and there’s upside for Shopify’s gross merchandise volumes as it gains traction with larger enterprise businesses, said Boone in the note.

JMP joins analysts at Oppenheimer, RBC Capital and CIBC Capital Markets with its US$65 price target, a Wall Street high, according to data compiled by Bloomberg.