Apr 17, 2024

Silver’s Record Industrial Demand and Deficit to Underpin Prices

, Bloomberg News

(Bloomberg) -- After a strong start to the year, silver should remain supported by record industrial usage and a supply deficit, according to the Silver Institute.

Industrial consumption hit an all-time high in 2023 and is expected to expand another 9% this year, driven by green-related applications such as solar panels, the institute said in its World Silver Survey report on Wednesday. That will help the metal record a fourth straight annual supply shortage.

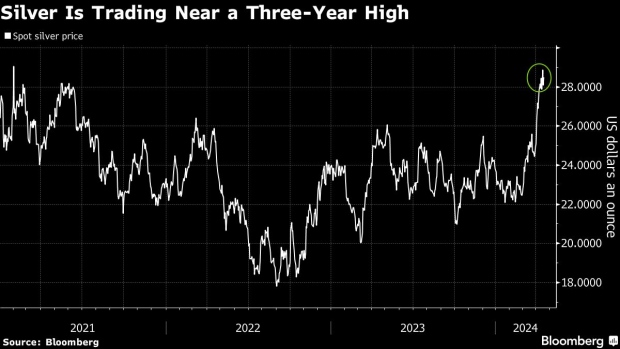

Silver, known as the devil’s metal because of its often wild swings, is trading near a three-year high as it tracks a rally in gold that has partly been fueled by demand for a haven amid geopolitical tensions. Silver prices will be underpinned by the persistent deficit, said Philip Newman, managing director at consultancy Metals Focus, which was commissioned to produce the report.

Silver has rallied 20% already this year to trade at about $28.55 an ounce in London. Prices could hit $30 in the near term, Newman said in an interview.

Here are some key figures from the report:

- Silver industrial demand is expected to reach 711 million ounces this year, with usage in solar panels climbing 20% to 232 million ounces.

- Jewelry purchases are seen rising 4%, while bar and coin demand will drop 13%.

- Total silver supply will ease slightly, leading to a deficit of 215 million ounces, the second-highest on record.

©2024 Bloomberg L.P.