Jan 18, 2019

'Things can't get worse': Why one portfolio manager is ready to buy Canadian energy stocks

, BNN Bloomberg

One portfolio manager is ready to buy into Canadian energy because “things can’t get worse than they are.”

The S&P/TSX Canadian Energy Index lost more than 20 per cent of its value in 2018. It has rallied alongside the broader TSX Composite in 2019, gaining 11 per cent on a year-to-date basis, but still isn’t far from a five-year low.

Portfolio Managemenet Corp. managing director Norman Levine sees this as a buying opportunity.

“We don’t like the political situation that exists in Canada as far as the energy sector goes, but we think that the stocks have been way over-done and we’re looking actually in the next little while maybe to be adding to that area,” Levine told BNN Bloomberg on Friday.

“The sentiment has been so bad and it was just ‘get me out’ and ‘we don’t care’ that – it’s not a get-rich thing – we think things can’t get worse than they are.”

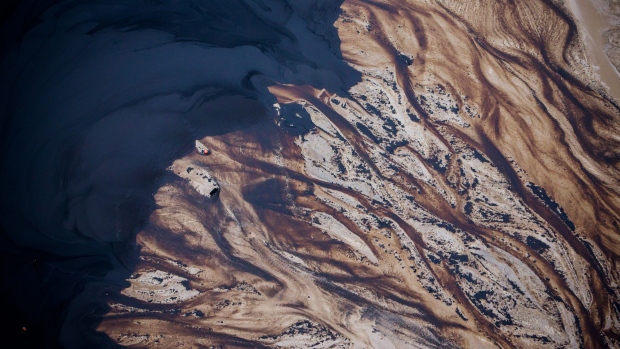

Canada’s energy sector took a beating in 2018, against the backdrop of national in-fighting over the planned Trans Mountain expansion project and a production glut in Alberta that widened the Western Canadian Select discount to as much as US$50 in October.

Levine said he isn’t ready to call a bottom for the TSX yet, despite its strong January thus far, but he said it’s natural for the index to see a bounce-back after getting pummeled in December.

“It was quite a painful fourth quarter, especially December. That was the worst December I can ever remember and it’s normal to get some kind of a bounce-back from that... I don’t know whether we’ve seen the lows or not,” he said.

“Anybody who says they know? They don’t really know.”