Iron Ore’s Big China Property Problem Just Isn’t Going Away

Iron ore’s recent mini-recovery can’t mask the fact that China’s push for a less property-intensive economy will keep demand subdued for years to come.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Iron ore’s recent mini-recovery can’t mask the fact that China’s push for a less property-intensive economy will keep demand subdued for years to come.

Shares of Arbor Realty Trust Inc., a lender to apartment buildings, dropped 4.9% after Viceroy Research accused the firm of fraud in its latest report.

Investors should buy the Australian dollar versus currencies like euro and Swiss franc, a strategy that benefits from a tighter Reserve Bank policy and minimizes risks associated with the greenback.

Equinix Inc.’s biggest rally in more than four years is squeezing short-sellers who piled into bets against the stock.

Canada’s oil-rich province of Alberta saw its economy shrink to 2004 levels on a per-person basis as the region’s population swelled, according to economist Charles St-Arnaud.

Jul 26, 2021

, Bloomberg News

Sales of new U.S. homes dropped unexpectedly in June to the lowest since April 2020, showing a further weakening in demand against a backdrop of elevated prices and tight supply.

Purchases of new single-family homes fell 6.6 per cent to a 676,000 annualized pace following a downwardly revised 724,000 in May, government data showed Monday. The median estimate in a Bloomberg survey of economists called for a 796,000 rate.

Surging construction costs for everything from labor to transportation to lumber have held back homebuilding in recent months, contributing to skyrocketing prices while the supply of homes remains limited. Some of those supply-chain pressures may ease in the coming months and lumber prices have retreated quickly from their recent peak.

Biden administration officials held a meeting with homebuilding industry representatives recently, with a goal of addressing the housing supply shortage and helping to ease pressures that spurred the surge in prices.

The Commerce Department’s report showed the median sales price of a new home rose 6.1 per cent from a year earlier, to US$361,800.

The number of homes sold in June and awaiting the start of construction -- a measure of backlogs -- eased from a month earlier to 229,000, the report showed. The total number of homes sold with construction underway slipped to 289,000 in June.

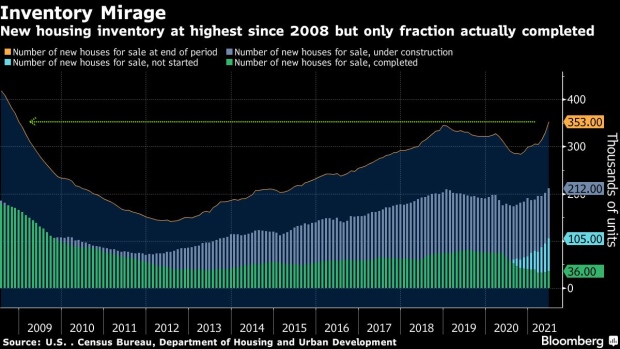

There were 353,000 new homes for sale in June, the most the end of 2008. At the same time, only 10 per cent of those houses were already completed. More than 100,000 had not been started.

At the current sales pace, it would take 6.3 months to exhaust the supply of new homes, compared with 5.5 months in the prior month.

A separate report last week showed sales of previously-owned homes rose for the first time in five months in June as housing inventory improved slightly.

Digging deeper