Jan 29, 2024

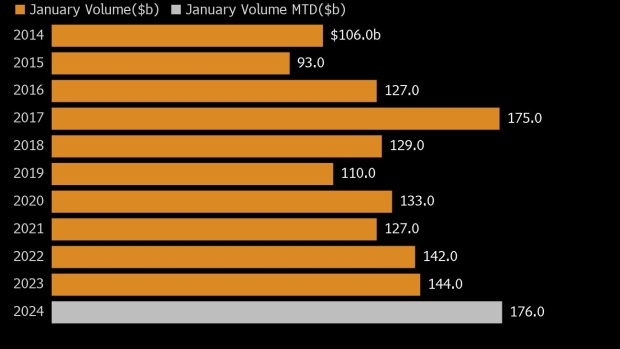

US Corporate Bond Sales Hit $176 Billion in Busiest January Ever

, Bloomberg News

(Bloomberg) -- Blue-chip firms have sold $188.57 billion of bonds in the US in January, setting a record for the month, as companies look to take advantage of drops in longer-term borrowing costs.

The sales broke the prior record for January of around $175 billion, set in 2017, according to data compiled by Bloomberg News. And more sales are probably coming through the end of the month, Wall Street bond syndicate professionals said.

“We could easily see $200 billion of sales this month,” said Jonny Fine, head of the investment-grade debt syndicate at Goldman Sachs Group Inc.

International Business Machines Corp., Capital One Financial Corp. and Kinder Morgan Inc. are among the companies tapping the market on Monday. Even if this month is the most active January on record, it is still short of the overall most active month for bond sales, April 2020’s $285 billion.

Sales have jumped after investors’ growing realization that the Federal Reserve was done raising rates to tame inflation and might start cutting soon pushed bond yields lower, trimming borrowing costs for companies. The average yield on a note maturing in 10 years or more had fallen to 5.44% on Friday, from 6.6% in mid-October.

Read more: A Record $721 Billion Debt Deluge Has Investors Wanting More

With those levels having dropped, some investors are eager to buy longer-term corporate bonds and lock in yields before they drop further. While January is usually one of the busiest months for high grade bond sales, the strong demand is making this month exceptionally busy.

“All types of issuers are finding a remarkable depth of liquidity,” said Fine. “And if you are a non-financial issuing 30-year bonds, you are kind of a unicorn right now.”

Bets that the world’s largest economy will likely avoid a more pronounced economic slowdown and that the Federal Reserve will this year start cutting interest rates are helping fuel a broad rally in risk assets. Average high-grade risk premiums are at their lowest in two years while US stocks drift near record highs.

New issues are finding unusually strong demand so far this year. Companies are selling bonds at slightly lower yields than their existing debt — known as a negative new issue concession — of 0.8 basis points as of Thursday. That’s unusual in a market where slightly higher yields for newer securities typically help draw in buyers.

Bank Bonds Bonanza

Goldman Sachs expects relatively heavy sales in the first half of the year before issuance slows in the second half, ahead of US November elections.

Financial institutions are leading the deluge. JPMorgan Chase & Co., Wells Fargo & Co., Morgan Stanley and Bank of America Corp. have raised a total of $28 billion this month.

Regional banks, including Truist Financial Corp. and Fifth Third Bancorp, are also active. These lenders might sell more long-term debt through their holding companies in the coming months in part to meet expected new regulatory requirements meant to boost financial stability.

“You’ve got to strike while the iron’s hot and get ahead of proposed long-term debt requirement,” said Nicholas Elfner, co-head of research at Breckinridge Capital Advisors. “Banks are also looking at their net interest margins and the cost of funds versus what they can lend them out at.”

To be sure, it’s not clear exactly when the Fed will start cutting rates, prompting some issuers that need to borrow now to mostly focus on shorter-dated bonds, according to Steven Boothe, head of global investment-grade fixed income at T. Rowe Price Group Inc. The money manager is buying “a little bit of everything” in the primary market but is keen to own the intermediate part of the curve versus the long end.

“The longer-dated spreads are pretty rich and that makes the index look a little tight from our perspective,” said Boothe.

--With assistance from Brian Smith and Michael Gambale.

(Updates January issuance volume in the headline, lead and chart.)

©2024 Bloomberg L.P.