Aug 6, 2020

ViacomCBS Rises After Streaming Prospects Outweigh Ad Decline

, Bloomberg News

(Bloomberg) -- Streaming video is the media world’s new favorite playing field, and ViacomCBS Inc. wants investors to remember it’s in the game.

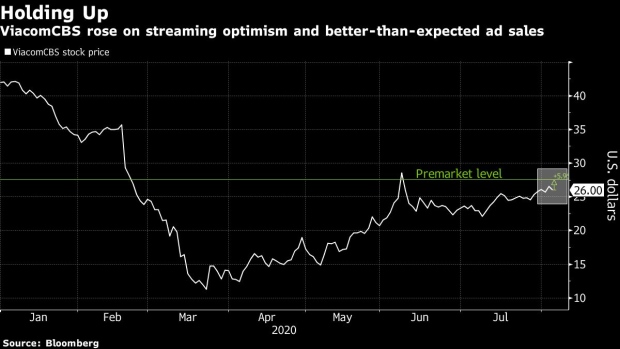

The entertainment company rose in premarket trading after highlighting growth in its streaming business as a bright spot last quarter. Its two pay services, CBS All Access and Showtime, now have more than 16 million combined subscribers. ViacomCBS’s free service, Pluto TV, has more than 33 million users worldwide.

The shares gained as much as 7.6% before the start of regular trading Thursday. They were down 38% this year through Wednesday.

ViacomCBS’s streaming offers still pale in comparison to market leader Netflix Inc., or even new entrant Walt Disney Co. But the company is really selling itself as a potential streaming player. It plans to introduce a revamped version of All Access early next year, adding shows from Nickelodeon, MTV and Comedy Central to a product mostly known for “Star Trek” spinoffs.

The New York-based company reported higher earnings and revenue than Wall Street expected. While sales fell in the most recent quarter, the impact from the coronavirus wasn’t as severe as many analysts and investors had feared.

Advertising sales fell 27% due to a sagging ad market and the cancellation of major sporting events such as the March Madness basketball tournament. While a declining market isn’t good news, TV advertising is holding up a bit better than most analysts had expected. AMC Networks Inc. and Fox Corp. also reported stronger ad sales than forecast.

The company’s film studio managed to bring in money even with almost all theaters closed. Paramount Pictures booked $209 million in revenue from home-video sales and rentals of recently released movies like “Sonic the Hedgehog,” and a further $434 million from licensing catalog movies to streaming services and distributors.

ViacomCBS said it will realize additional synergies from the merger of the former Viacom Inc. and CBS Corp. Cost savings this year will reach $300 million, up from projections of $250 million.

The merger united two struggling media companies, both of which are reliant on a declining TV business. Identifying cost savings was one of the big reasons to do a deal.

©2020 Bloomberg L.P.