Jan 24, 2024

World’s No. 2 Memory Chip Maker SK Hynix Reports Surprise Profit

, Bloomberg News

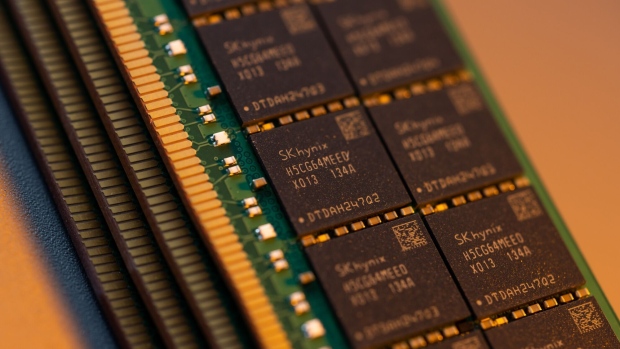

(Bloomberg) -- SK Hynix Inc. posted its first operating profit in more than a year and affirmed plans to build high-end memory capacity to meet AI demand, the latest to signal hope for a long-delayed rebound in 2024.

The world’s No. 2 maker of memory chips reported an operating profit of 346 billion won ($259 million) in the December quarter, beating analyst estimates for another loss on a 47% jump in revenue. Its shares however slid 2.9% in Seoul, giving up a sliver of the near-90% it gained over 2023.

The company, which in December became South Korea’s second-most valuable firm, is the leader in high-bandwidth memory chips that work alongside Nvidia Corp.’s AI accelerators, used extensively in the training of AI. Investors are pinning their hopes on generative AI driving demand for servers that require more next-generation DRAM, or DDR5.

“SK Hynix recorded higher ASPs because of their higher exposure to premium products such as HBM3 and DDR5,” Daiwa Securities analyst SK Kim told Bloomberg Television. “Nvidia is maintaining their dominant position in the AI GPU market, so Hynix will continue to benefit from this landscape at least in the first half of this year.”

The company is considering producing DDR5 and LPDDR5 — the latest generation of memory used in PCs and smartphones — at its fab in Wuxi, China by transitioning the production line to 10-nanometer class products, Chief Financial Officer Kim Woo Hyun said during a conference call Thursday.

SK Hynix sees DRAM inventory levels normalizing in the first half of the year, with NAND inventory following suit in the second half, as production cuts kick in. Prices of NAND began rising in the fourth quarter, it said.

The prolonged slump continues to weigh on SK Hynix and its ability to make aggressive investments, however. On a net basis, the company logged a bigger-than-expected loss of 1.36 trillion won on a writedown on its investment in Japanese chipmaker Kioxia Corp.

“There were expectations for a turnaround,” said An Hyungjin, chief executive officer and fund manager at Billionfold Asset Management. “SK Hynix could have done even better.”

The memory maker is reporting days after larger rival Samsung Electronics Co. unveiled disappointing numbers, reflecting a semiconductor market slump that’s depressed margins for more than a year. Industry executives, however, have projected a gradual rebound starting 2024, especially as AI development accelerates and more services emerge that take advantage of new chip technology.

Chipmakers are optimistic about a sector recovery, with Taiwan Semiconductor Manufacturing Co. last week projecting strong revenue growth in 2024. ASML Holding NV, the sole maker of high-end lithography equipment key to manufacturing the most sophisticated semiconductors, closed at a record high Wednesday after orders more than tripled last quarter.

AI-powered smartphones and PCs are driving chip demand, SK Hynix said. The company plans to boost overall capital spending, even while continuing to cut back on legacy chip output in 2024. It will proceed with mass production of AI memory product HBM3E, focusing spending on high-bandwidth memory and other strategic products.

Sales of HBM3 surged more than fivefold in the fourth quarter, while those of DDR5 chips more than quadrupled, the company said. SK Hynix now expects demand for both DRAM and NAND to grow by mid- to high-teen percentages in 2024, echoing predictions for a market bounce-back this year.

Hynix is the first company in its peer group within the memory industry to recover from a string of losses, and HBM chips will likely help drive recovery in the coming quarters, said Sanjeev Rana, an analyst at CLSA Securities Korea.

ASML the previous day reported a big pickup in orders from memory makers in the December quarter, which alarmed investors who may be worried about an aggressive ramp up in production capacity and another supply glut, said Rana. But most of these orders should be for delivery in late 2024 or 2025 and “should not impact the near-term strong outlook for memory pricing,” he said.

--With assistance from Youkyung Lee and Vlad Savov.

(Updates with analyst comments and closing share price)

©2024 Bloomberg L.P.