Sep 29, 2022

Another Wall Street Bank Bets on Pound-Dollar Parity By End of Year

, Bloomberg News

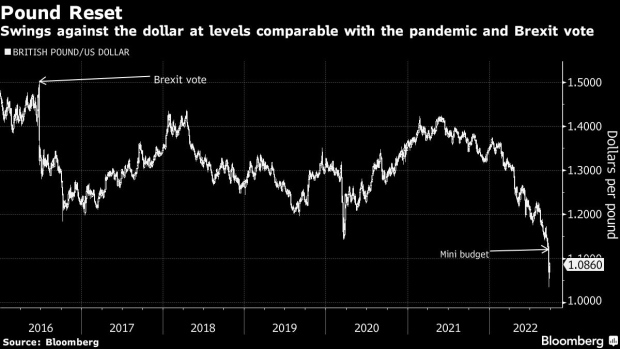

(Bloomberg) -- The UK is walking into the kind of existential crisis last seen when the country voted to leave the European Union, putting a slide in the pound to parity with the dollar in sight, according to a Bank of America Corp. currency strategist.

The “back-of-the-envelope economics” from the new government’s fiscal plans in the past week have done nothing to foster investor confidence in the UK, strategist Kamal Sharma wrote in a note to clients. Rising borrowing costs are exposing the strain on public finances, he said.

It’s the latest call by a Wall Street bank to bet on pound parity by the end of the year, following similar recommendations from Morgan Stanley and Citigroup Inc. Sharma said elevated inflation combined with a stagnant economy will continue to depress sterling, which is trading at around $1.08 after hitting a record low on Monday.

Still, the government continues to stand by its fiscal plans, with UK Prime Minister Liz Truss defending her set of tax cuts. She instead blamed global economic pressures for the fallout from a mini-budget last week.

“Countries with better debt dynamics than the UK have been treated more harshly than the pound has up to now,” said Sharma. “But one cannot escape the notion that the Great British Pound Reset has further to go.”

©2022 Bloomberg L.P.