Sep 4, 2022

Australia Set for Fourth Half-Point Hike in Race to Cool Prices

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

Australia’s central bank is relying on powerful consumer demand to help the economy absorb its rapid interest-rate increases, setting aside for the time being the specter of a broad-based housing downturn.

The Reserve Bank will raise its overnight cash rate target by a half-percentage point to 2.35% at Tuesday’s meeting, according to 27 of 30 economists surveyed by Bloomberg, in what would be its fourth straight move of that size.

Standard Chartered Plc sees a 40 basis-point hike that would remove an anomaly created during the pandemic when rates were cut to a record-low 0.1%, while Bloomberg Economics and Barclays Plc see a quarter-point move.

Australian policy makers, like their global counterparts, are striving to prevent inflation spiraling out of control. They anticipate the A$10 trillion ($6.8 trillion) housing market will avoid forced sales, as many mortgage holders made advance repayments and high employment lets them meet their commitments.

“Usually in tightening cycles, the RBA would do some rate hikes and then wait to see what happens,” said Diana Mousina, senior economist at AMP Capital Markets. “But they’re just not giving themselves any time to watch the data because they’re worried that inflation’s too high.”

Consumer-price growth in the second quarter was 6.1%, double the upper end of the RBA’s 2-3% target, and is expected to peak at just under 8% late this year.

RBA Governor Philip Lowe will deliver an address on Thursday titled “Inflation and the Monetary Policy Framework.”

What Bloomberg Economics Says...

“The RBA has signaled it may now slow the pace of its tightening. The central bank in August said it has no “pre-set path” to policy moves and we see a 25 basis-point hike this month.”

-- James McIntyre, economist

For full note, click here

A combination of pandemic-era stimulus and unemployment of just 3.4% has unleashed a boom in household spending. Retail sales surged 1.3% in July and this together with high export prices is expected to fuel the economy’s expansion.

A private report Monday showed Australian job advertisements reached a new high in August, signaling solid labor demand ahead.

All that suggests RBA rate hikes are yet to hit demand significantly. Gross domestic product likely rose 1% in the three months through June from the prior quarter, and 3.5% from a year earlier, economists predicted ahead of data Wednesday.

Yet the property market is struggling to absorb the RBA’s 1.75 points of hikes in the four months since May, when the cash rate stood at 0.1%.

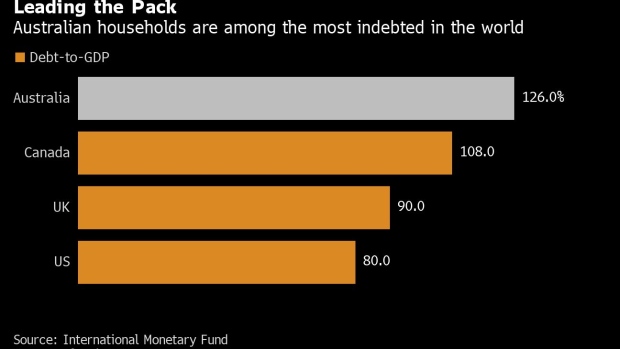

House prices fell in August at the fastest pace since 1983. The concern is the downturn will reverberate through the A$2.2 trillion economy, with the nation’s households among the world’s most indebted.

RBA rate rises take about three months to flow through to households, says Commonwealth Bank of Australia, the nation’s largest lender. That suggests consumers are only now feeling the effect of the initial hike. Also, about a third of mortgages are on fixed terms, further insulating them from tightening.

That helps explain why Australian consumers are still spending heavily.

“Many households with mortgages will need to adjust their spending patterns over the period ahead as the lagged impact of rate hikes negatively impacts their cash flow,” said Gareth Aird, head of Australia economics at CBA, which accounts for a quarter of Australia’s total mortgage market.

Aird pointed to forward-looking surveys that suggest “the economy could slow quite materially from here, particularly given monetary policy is expected to be tightened further.”

RBA policy makers are trying to engineer a soft landing, while acknowledging that the path to cooler inflation while maintaining solid growth is a narrow one. A Bloomberg survey showed the median estimate of economists is a 23% chance of recession over the next 12 months.

That’s one reason why AMP’s Mousina also sees the possibility the RBA might opt for a smaller 40-basis-point hike on Tuesday.

“That would help bring the cash rate back to a more normal level,” she said. “It would also indicate that the pace of tightening can slow down because we know in Australia that interest rate hikes tend to be more potent.”

(Adds updated forecasts, job advertisements, comment from CBA economist.)

©2022 Bloomberg L.P.