Apr 9, 2024

Barrage of Short Wagers Leaves Bonds Primed for Post-CPI Squeeze

, Bloomberg News

(Bloomberg) -- Treasury bond traders have turned so bearish ahead of a key inflation report that they risk getting squeezed on a less than red-hot reading.

Funds that use borrowed money to amplify returns increased short positions in the Treasury futures market for the first time in two months amid the recent rise in US yields, weekly data from the CFTC shows. Investors also boosted bearish wagers in the cash market, with JPMorgan Chase & Co.’s latest client survey showing a rise in short positions that left clients net neutral — as opposed to net long — for the first time in almost a year as of April 8.

Treasury yields reached their highs for the year this week after signs of a buoyant US economy and cautionary comments from central bankers caused traders to keep scaling back expectations for interest-rate cuts in 2024. Both Friday’s and Monday’s trading sessions showed a buildup of short positions based on changes in open interest that reflected traders hedging against the risk of a further rise in Treasury yields.

On Tuesday, US bonds recouped some of their recent losses, sending yields down a touch from their highs. Now, traders await a crucial report on consumer prices Wednesday that may either validate their more hawkish stance — or cause yet another repricing.

Economists forecast that consumer prices rose 0.3% in March on a monthly basis, both overall and excluding food and energy costs. With the market positioned so bearishly, a softer reading has the potential to trigger a more dramatic reaction, analysts at Wells Fargo & Co. wrote in an April 5 report.

“On the heels of the bond market’s recent poor performance, we think US yields will react more sharply if core CPI prints below the 0.3% Bloomberg consensus than if it comes in hot,” they wrote.

Already, there are signs that some investors may be looking to close out bearish bets ahead of the data. Tuesday’s gains in shorter-dated securities got a big boost from a record-size block trade in short-term interest-rate futures, which appeared consistent with an outright buyer.

With yields at their highs for the year, the large trade could be an early sign that some are seeing the bond market as overly stretched on the short side. Also, Commodity Futures Trading Commission data shows some asset managers have been willing to take on more interest-rate risk lately.

Read more: Bond Trader Places Record Futures Bet on Eve of Inflation Data

Here’s a rundown of the latest positioning indicators across the rates market:

Treasury Clients Short

JPMorgan’s latest survey of Treasury clients showed shorts rising 2ppts, leaving clients net neutral for the first time since April 17, 2023. On an outright basis, short positions remain the biggest since the start of the year while outright longs are the fewest since February.

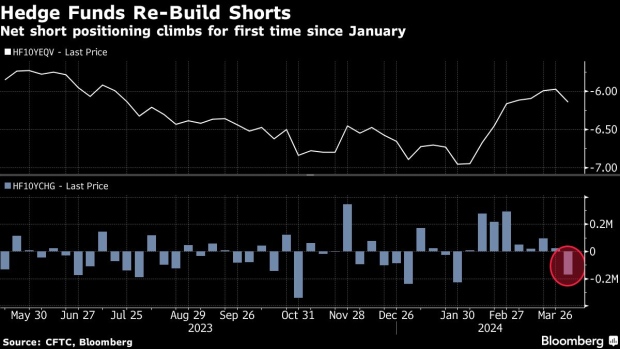

Hedge Funds Rebuild Futures Shorts

The latest CFTC data covering the week leading up to April 2 showed that leveraged funds extended their net short position for the first time since the end of January. The add to short positioning was equivalent to approximately 171,000 10-year note futures equivalents, with most of the net short being extended in the five-year note contract for a risk weighting of $6.8 million per basis point.

On the other side of the trade, asset managers rebuilt long duration bets by the most since August last year, adding to net long duration positions by around 222,000 10-year note futures equivalents.

Expensive to Hedge Bond Selloff

The premium paid to hedge a selloff in Treasuries remains elevated, with the highest premium seen via the so-called put/call skew on futures in the long-end of the curve during a week in which yields across all tenors rose. Flows in the options market this week have reflected this bearish sentiment, including a bunch of trades seen Monday targeting a move beyond 5% in both 5- and 10-year Treasuries.

Bearish Trades in Treasury Options Target 10-Year Yield Above 5%

SOFR Options Most Active

Over the past week the most active SOFR options strike has been the 95.0625 and 94.9375 strikes, where last week’s activity included buying of the Jun24 94.9375/95.0625/95.1875 call fly and the Sep24 94.9375/95.0625/95.1875 call fly. A standout flow also included decent buying in the Jun24 94.875/94.9375/95.00/95.0625 call condor.

SOFR Options Heat-Map

The most populated SOFR strike out to the Dec24 tenor remains the 95.50 targeting a 4.5% yield, where a heavy amount of risk can be seen in the Jun24 calls, Sep24 calls and Dec24 puts. Other populated strikes include the 95.00, 95.25 and 94.875 levels, where both Jun24 calls and puts are highly populated.

--With assistance from Elizabeth Stanton.

©2024 Bloomberg L.P.