Dec 21, 2023

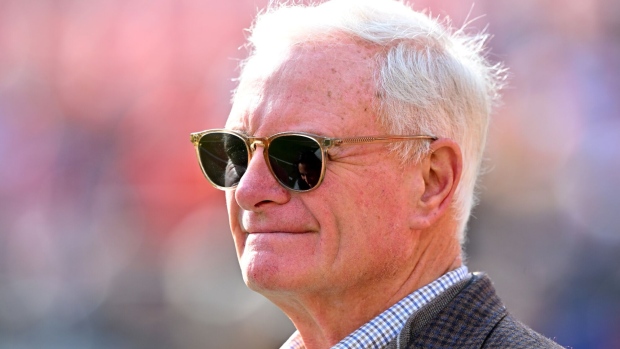

Berkshire Alleges Billionaire Haslam Admitted to 'Shadow' Executive Payments

, Bloomberg News

(Bloomberg) -- Berkshire Hathaway Inc. said billionaire Jimmy Haslam admitted to offering payments to executives at Pilot Travel Centers as he prepares to sell his remaining stake in the truck-stop chain to Warren Buffett’s company.

A lawyer for Berkshire told a Delaware judge Thursday that Haslam — whose family owned Pilot Travel until selling Berkshire a controlling stake — acknowledged in a pre-trial deposition that he’d promised to reinstate his own “executive compensation plan” and would make payments to 24 executives after he sells his final 20% stake.

Berkshire has alleged Haslam offered millions of dollars in “side payments” to the executives as an incentive to boost the chain’s short-term profit and inflate the value of his 20% stake. Federal prosecutors in New York are investigating the allegations, Bloomberg News reported this month.

Despite Haslam’s denials, a “shadow executive-compensation plan actually exists,” Ryan Stottmann, the Berkshire attorney, said during a court hearing on whether the billionaire should face further questioning about the payment plan.

Read More: Billionaire Jimmy Haslam Probed Over Promised Pilot Payments

Delaware Chancery Court Judge Morgan Zurn ordered Haslam to submit to a continuation of his deposition over the objection of his lawyer.

Liz Cohen, a spokesperson for Haslam, didn’t immediately respond to an email seeking comment. A lawyer for Haslam said in an earlier court hearing that the allegations about an illicit payment scheme were an “invention” by Berkshire’s attorneys.

The jousting is part of escalating legal battle over the remaining Pilot Travel stake. Haslam sued Berkshire over the accounting methods to be used in valuing the stake.

A trial is set for January over Haslam’s claim that Pilot Travel executives installed by Buffett have changed quarterly-earning accounting methods in a way that will cut the value of his holdings by $1.2 billion. Buffett’s lawyers argue Berkshire had the right to change the accounting after the company gained majority control of the truck-stop chain.

Zurn already ruled Berkshire can’t use evidence of the executive payment plan to bolster its defenses to Haslam’s claims. But the judge didn’t bar Berkshire’s attorneys from questioning Haslam and other witnesses about them in the January trial.

Read More: Truck Stop Tycoon Battles Buffett to Add to $18 Billion Fortune

Berton Ashman Jr., one of Haslam’s lawyers, told the judge that Berkshire attorneys already questioned Haslam about the payments in the earlier deposition and shouldn’t be allowed to re-plow the same ground. “They don’t need this evidence and they aren’t entitled to it,” Ashman said, adding that his adversaries were seeking a “back-door way” to inject the payments into the trial.

But Zurn said Berkshire’s lawyers deserved a chance to test Haslam’s credibility about the payments. Sitting for another hour of pre-trial questioning shouldn’t be “too burdensome,” she said.

The case is Pilot Corp. v. Abel, 2023-1068, Delaware Chancery Court (Wilmington).

(Updates with Buffett’s argument on accounting change in eighth paragraph)

©2023 Bloomberg L.P.