Apr 8, 2024

Blackstone Bet Spurs Biggest Apartment-Stock Jump in Four Months

, Bloomberg News

(Bloomberg) -- The stocks of apartment landlords staged the biggest rally in nearly four months after Blackstone Inc., the world’s largest commercial real estate owner, stepped up its bet on the industry.

An index tracking the group rose over 4%, the largest one-day jump since mid-December, after Blackstone said it plans to acquire Apartment Income REIT for roughly $10 billion. While the industry’s shares remain well below their early 2022 peak, the gain erased this year’s losses and was seen as bolstering investors’ confidence in the sector.

The planned purchase follows Blackstone’s agreement in January to buy the single-family-home landlord Tricon Residential Inc. for $3.5 billion, and Blackstone President Jon Gray previously told investors that “real estate values are bottoming.”

BTIG analyst Michael Gorman said Blackstone’s decision “is likely to spur additional bullish sentiment for the group beyond the current supply wave impacting fundamentals.”

The rally was led by Apartment Income REIT, which jumped 22% to $38.38, just shy of the $39.12 per-share purchase price. But the broader sector also advanced, with all 13 members of Bloomberg’s apartment real estate investment trust index gaining.

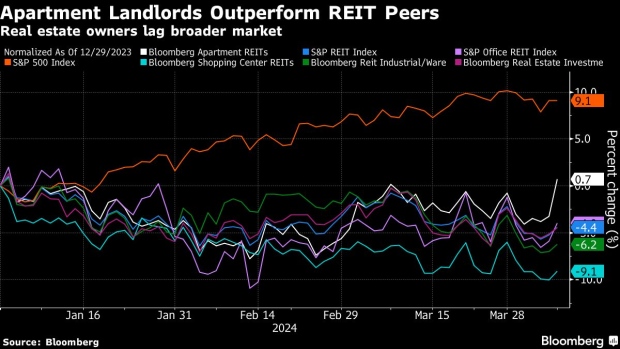

Apartment landlords are among the best performers in the REIT industry year-to-date. Following Monday’s gain, the sector is up 0.9% for the year after being down more than 3% at Friday’s close.

Wall Street analysts have been mixed toward Apartment Income REIT — with Bloomberg data showing four buy ratings, seven holds and 0 sells. BMO Capital Markets downgraded the stock to market perform from outperform Monday following the announcement, saying it doesn’t expect a competing bid that would push the stock higher.

Piper Sandler analyst Crispin Love said it may be a sign that broader deal activity is poised to pick up in the real estate industry, making him more positive on 2024.

“We view Blackstone to be in an advantageous position with patient capital and the ability to move quickly with size given its substantial real estate dry powder,” Love wrote in a note to clients.

(Updates chart, AIRC analyst ratings. An earlier version was corrected to say apartment REITs among best performers.)

©2024 Bloomberg L.P.