Mar 18, 2024

Brazil Economy Starts 2024 With Modest Growth, Backing Interest Rate Cuts

, Bloomberg News

(Bloomberg) -- Brazil’s economic activity expanded for the fifth straight month at the start of the year as investors mull how long the central bank will continue with half-point interest rate cuts after Wednesday’s policy meeting.

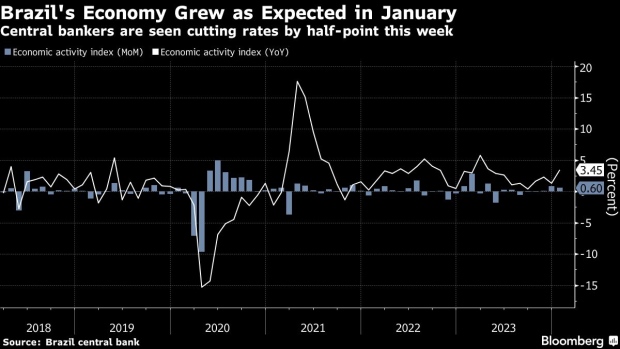

The central bank’s economic activity index, a proxy for gross domestic product, rose 0.6% in January from the month prior, in line with the median estimate from analysts in a Bloomberg survey. From a year ago, the gauge gained 3.45%, according to data published on Monday.

Latin America’s largest economy has shown some strength in the face of high rates, as evidenced by strong retail sales and formal job creation. Analysts have raised their 2024 GDP estimates to 1.78%, while the government sees growth near 2%. Still, credit-driven businesses are hurting under tight lending conditions, and in January industrial production fell for the first time since July.

The result backed some analyst views that the economy has remained resilient in the first months of the year, helped by consumption. “January was a month of mostly positive results,” Gabriel Couto, an economist at Santander SA in Brazil, wrote in a research note. Still, recent prints of industrial production point to a deceleration.

Read More: Lula Pulls Off Rare Trick Twice, Wooing Wall Street and the Poor

Pressed by falling popularity among the poor, President Luiz Inacio Lula da Silva is pushing for an increase government spending. In recent weeks he has also moved to expand his influence over state-controlled companies such as Petroleo Brasileiro SA, in a bid to use their investments to help drive economic growth.

Read More: Petrobras CEO in Hot Seat as Lula Pushes Growth Over Payouts

Central bankers led by Roberto Campos Neto will likely extend their easing cycle with a sixth half-point Selic cut on Wednesday. They have signaled plans to eventually pause reductions with rates still at restrictive levels, prompting analysts and traders to bet on borrowing costs at 9% to 9.5% in December.

--With assistance from Giovanna Serafim.

(Recasts, adds economist comment in fourth paragraph)

©2024 Bloomberg L.P.