Dec 28, 2021

Brexit Deal May Be Too Little, Too Late for U.K.’s Car Industry

, Bloomberg News

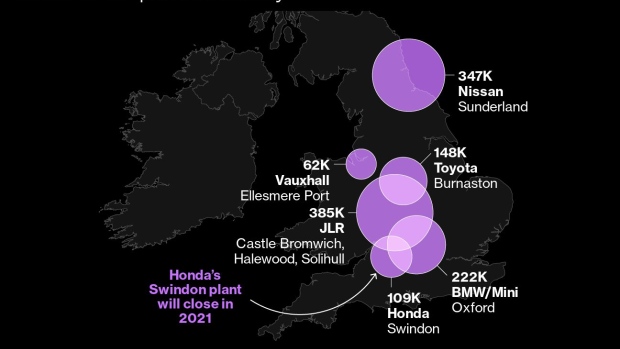

(Bloomberg) -- The auto industry dodged disaster when the U.K. and European Union sealed a post-Brexit trade accord, but not before carmakers announced factory closures and called off plans to make several new vehicles in the country.

More damage may still be done even with last week’s deal. Automakers including Nissan Motor Co. might struggle to qualify some U.K.-assembled models for tariff-free export to the EU as they evaluate whether they source enough of their components locally. Costs associated with having to switch suppliers and the burdens of customs declarations, certifications and audits could still leave car companies convinced they’re better off investing elsewhere.

“This is still a thin deal with major implications and costs for automotive,” said David Bailey, a business economics professor at Birmingham Business School in England. “Much will depend on the degree of flexibility allowed and the degree of phasing in.”

The stakes for the U.K. economy are massive. The country’s auto industry employs more than 860,000 people, over a fifth of whom are on staff at vehicle and parts factories. The sector sent 42.4 billion pounds ($57 billion) worth of cars and components overseas last year, 13% of the nation’s total exports. The Brexit deal eliminates the risk of widespread exodus but still could fall short for carmakers with too little leeway to take on more expenses.

Ones to Watch

Nissan and its Japanese peers are the companies to watch in the wake of the deal. The outlook already was bleak before the Brexit accord was clinched.

The company recently decided against making an electric model at its Northern England factory and almost two years ago scrapped plans to build another sport utility vehicle at the same site. Honda Motor Co. is closing its only U.K. car plant next year.

Nissan and Toyota Motor Corp.’s hybrid and electric models built in England are cut some slack in the Brexit trade deal, with the accord allowing a greater proportion of vehicle content to come from outside the U.K. or EU. Still, the initial so-called rules of origin require 10 percentage points more local content than what the U.K. sought.

It’s unclear whether Nissan’s all-electric Leaf hatchbacks built in Sunderland have enough local content to avoid levies. While Nissan welcomes the trade agreement, it will now “assess the detailed implications for our operations and products,” Azusa Momose, a company spokeswoman in Yokohama, said by email.

Toyota’s Corolla hybrid compact cars built in Burnaston as well as the non-electrified vehicles assembled at the site qualify for tariff-free export to the EU, said Sonomi Aikawa, a company spokeswoman in Tokyo. The company benefits from its engine plant in Wales, she said.

The carmakers’ tariff requirements going forward may be affected by their plans to bring more of their battery supply chains to the region. Electric vehicles will be given another six years to bring their amount of foreign content below 45%, the threshold gasoline and diesel cars will be held to immediately.

“The timings underscore the urgent need for government to create the conditions that will attract large-scale battery manufacturing to the U.K. and transform our supply chains,” said Mike Hawes, chief executive of the Society of Motor Manufacturers and Traders, the U.K. car industry’s trade group. “Improving the competitiveness of the U.K. will be essential to help mitigate the additional costs and burdens brought about by our new trading relationship.”

‘Green Light’

Other carmakers have been putting off investments in U.K. plants pending the outcome of trade talks.

BMW AG delayed work on a next-generation Mini platform due to uncertainties over the U.K.’s trade relations with the EU. Chief Financial Officer Nicolas Peter said this month BMW would consider making Mini cars in Germany or China if tariffs undermine the business case of producing them in the U.K.

PSA Group CEO Carlos Tavares said in March the maker of Vauxhall cars would determine whether there was a business case for its factory in Ellesmere Port, and that the company could ask the British government to compensate for any trade barriers that may arise.

BMW and PSA welcomed the trade deal, while cautioning that they’d need to closely examine the agreement to assess the implications for their operations.

“It’s hoped that the deal now gives a green light to major investments in the U.K. that had been stalled amid Brexit uncertainty,” said Bailey, the Birmingham Business School professor. “There will be extra costs for the industry in terms of non-tariff barriers, but things could have been much worse.”

©2020 Bloomberg L.P.