Sep 1, 2022

China’s Power Worries Shift to Winter as Reservoirs Are Depleted

, Bloomberg News

(Bloomberg) -- The historic drought that led to power outages in parts of China last month has left reservoirs depleted, raising fears that regions dependent on hydropower will be at risk of another electricity crunch this winter.

The power crisis in the southwestern province of Sichuan and the neighboring municipality of Chongqing has mostly abated this week, after officials curtailed electricity to many industrial customers to meet demand for air-conditioning amid the scorching temperatures. But the reservoirs that Sichuan relies on for about 80% of its power capacity remain low, which could constrain electricity generation through the rest of the year.

“The risk is still high in the coming winter for hydro-rich provinces,” said Xizhou Zhou, head of global power and renewables at S&P Global Commodity Insights. “Even with power imports from other provinces, it remains uncertain whether Sichuan could cope with the winter peak load.”

The energy crunch in the summer has heaped more pressure on China’s economy. Factory activity contracted in August for a second straight month, as the power shortages added to the stresses inflicted by a property market crisis and Covid-19 flareups.

From the start of July to late August, Sichuan had the lowest amount of rain since record-keeping began in the 1960s. That left key reservoirs in the region with about 1.2 billion cubic meters of water by late last month, 4 billion less than at the same time in 2021.

The drought hit during what’s supposed to be the region’s wet season, with hydropower generation usually peaking between June and October, Andrew Polk, co-founder of consultancy Trivium China, said on Twitter.

“Sichuan is now at such a water deficit that it would take a meteorological miracle to reach anything approaching normal levels before winter power production,” he said.

Still, heavy rains have drenched the province this week. And Sichuan is also a major exporter of hydropower, which could allow the central government to prioritize preparing the province for winter over sending clean electricity to energy-hungry eastern cities.

Just a few months ago, China was receiving abundant rainfall, pushing hydropower generation to a record over the first half of the year. Even after the drought, cumulative water flow through the end of August was higher than in 2021, said Zhan Pingyuan, chief financial officer of China Yangtze Power Co., which operates several of the world’s biggest dams along the Yangtze and its tributaries. The company, which hosted a conference call Thursday to discuss first-half earnings, said September and October rainfall levels will be key.

“There have been historical cases where the first half’s flow is extremely bad, but autumn floods saved the entire year’s power generation,” said Xue Ning, the company’s board secretary. “Anything could happen, and it is difficult to make accurate predictions sometimes.”

Events Today

- Caixin’s China factory PMI for August, 09:45

- Yangtze Power briefs on earnings, 10:00

- USDA weekly crop export sales, 08:30 EST

Today’s Chart

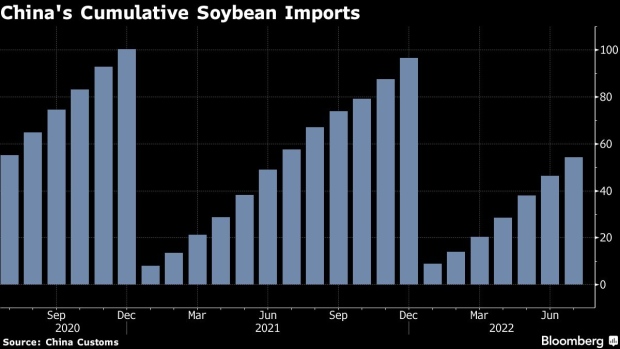

China’s soybeans imports are picking up after falling behind last year’s pace. Buyers have booked at least 40 cargoes from the US and South America in the past two weeks alone as international prices have dropped. Traders are taking advantage of improved processing margins and rebuilding stockpiles ahead of festivals that run from the autumn through to the Lunar New Year.

On The Wire

A decline in China’s Caixin PMI into contraction in August added to evidence that the manufacturing sector’s recovery lost momentum.

China’s coastal provinces are preparing for the strongest global storm of 2022, with Super Typhoon Hinnamnor set to move northward into the East China Sea.

- Chinese Energy Stocks Up on New Additions to FTSE China Indexes

- Iron Ore Holds Around $100 a Ton as Peak Building Season Looms

- China Should Prevent Its Solar Industry From Overheating: Daily

- IRON ORE FLOWS: Australia Weekly Exports Rise to 16.3M Tons

- China’s New Green Plans Could Help Meet Stringent Energy Goals

- China Wind-Turbine Firms Could Find Europe Market Hard to Grasp

- VENEZUELA TRACKER: Crude Exports Slump 26% on China, Cuba Cuts

The Week Ahead

Friday, Sept. 2

- Shenhua briefs on earnings, 10:00

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

©2022 Bloomberg L.P.