Apr 13, 2022

CLOs Face Pain From Looming Risk of Leveraged Loan Downgrades

, Bloomberg News

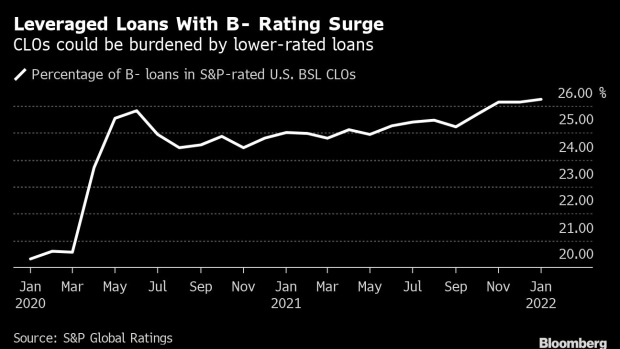

(Bloomberg) -- There have never been so many leveraged loans on the cusp of the lowest tier of ratings, and the biggest buyers of the debt could be clobbered by any wave of downgrades.

Around a quarter of the loans in the S&P LSTA Leveraged Loan Index are rated B-, the lowest level that many money managers can easily buy. That’s the highest proportion on record, according to Barclays Plc.

If those loans are downgraded by at least one notch in another downturn, their prices could plunge, as the biggest buyers of the debt are forced to sell their holdings. These purchasers, money managers that bundle loans into bonds known as collateralized loan obligations, face strict limits on how much CCC tier debt they can own. During the early part of the pandemic, fears of mass downgrades weighed on CLO prices.

This time around, investors seem relatively unconcerned about this risk as they pile into the rare investment that can offer higher yields when the Federal Reserve is hiking rates. Loan prices have gained around 2 cents on the dollar since mid-March, to about 98 cents on average, close to the mean level from 2021, while returns for the year have turned positive.

But Barclays called the growing percentage of B- loans “worrisome” for CLOs in a report late last week, and said the market isn’t paying enough attention to tail risk, or the potential for seemingly improbable outcomes to hurt performance. The compensation for B- rated loans compared with higher quality loans is essentially at post-crisis lows, the bank noted.

“While the actual percentage of CCC rated loans in the loan index is smaller now than it was in mid-2020 -- only 5% now, versus 11% then -- there are lots of credits that are just one notch away from CCC,” Jeff Darfus, a credit research analyst at Barclays, said in a phone interview.

CLOs, which buy about two thirds of the $1 trillion loan market, are often contractually obliged to keep no more than 7.5% of their money in debt rated CCC or lower. If they exceed those levels, they can be forced to cut cash payments to some investors, or to dump loans at fire-sale prices.

Barclays analysts aren’t forecasting a wave of loan downgrades, or trouble for CLOs, in the near term. There have been more upgrades than downgrades so far this year, as corporate earnings continue to recover from the pandemic. And CLOs hold just 3.4% of their portfolios in CCC loans, giving them capacity to sustain downgrades and still be below their upper limits.

But the Fed is also engaging in monetary tightening, and short-term rates have risen to the point where most leveraged loan borrowers will have to pay more interest on their debt.

“Rising rates for loan issuers will increase interest expense,” Darfus said. “If inflation stays elevated and you have rising input costs, it could start pressuring margins for some of these companies,” leading to downgrade risk.

CLO 2020 Success

Loan investors faced a downgrade wave in 2020 as the pandemic ramped up, but it all worked out relatively well for CLOs as the Fed and lawmakers flooded the financial system with money. Defaults for CLOs have been few and far between, and U.S. CLO issuance reached a record in 2021.

“Because the rating agencies preemptively downgraded loans in the early part of the pandemic, before financial results were in, it caused problems for CLO managers,” said Drew Sweeney, a managing director at the TCW Group who focuses on leveraged loans. “But it wasn’t accurate in many ways,” especially for segments like fast-food restaurants that were initially downgraded but quickly rebounded during the pandemic since they offered drive-through service.

The current economy will probably bring downgrades at a more measured pace, which is typical for a cyclical downturn, Sweeney said. That means ratings firms will probably wait for companies’ financial results before downgrading.

“Today, I’m not terribly concerned with the percentage of B3 rated loans in the market,” Sweeney said. “But in six months from now, with rates higher and companies with more leverage, there might be more risk.”

Elsewhere in credit markets:

Americas

- Apollo Global Management Inc. has approached the banks behind the buyout financing for Citrix Systems Inc. with an offer to purchase as much as $4 billion of the debt together with other private credit funds.

- Power producer Talen Energy Corp. is seeking $1 billion or more in bankruptcy financing as some of its secured debt holders are preparing to sign confidentiality agreements this week to advance restructuring talks, according to people with knowledge of the situation.

- A group of banks led by JPMorgan Chase & Co. is struggling to sell a $585 million junk bond to help fund the acquisition of building materials business Oldcastle BuildingEnvelope Inc. by buyout firm KPS Capital Partners, according to people with knowledge of the matter

- Grupo Kaltex, one of Mexico’s biggest textile producers, fell into default after it failed to pay back $218 million of bonds maturing Monday, but is expected to restructure its debt in the coming weeks, according S&P Global Ratings

- Join us April 27 at 10am ET for Bloomberg’s U.S. Leveraged Loans Conference with Sycamore’s Mark Okada, Antares’s Anthony Diaz, Octagon’s Gretchen Lam, Blackstone’s Dan McMullen, Rockford Tower’s Young Choi, New Mountain’s Laura Holson and Goldman Sachs’s Chris Bonner. Click here to register for the event.

- For deal updates, click here for the New Issue Monitor

- For more, click here for the Credit Daybook Americas

EMEA

Four issuers in the primary market in Europe sold 3.55 billion euros ($3.87 billion), including Croatia.

- Battery maker Varta sold a 250 million euro ESG-Linked Schuldschein deal

- Bond markets and ratings companies are signaling widespread defaults across Russia Inc., with five-year probability of default now higher than 90% for 36 of 43 Russian entities covered

- The riskier equity portions of European collateralized loan obligations are flashing a warning sign for investors, according to strategists at Bank of America Corp.

Asia

China’s offshore high-yield credit reached a critical juncture, falling back again in recent days after key metrics showed stress reaching record levels last month. Distress in the nation’s $870 billion offshore debt market remained at the highest level, a tracker showed.

- Sunac’s dollar notes fell for a fifth day Wednesday, continuing to reverse a recent rebound, as the Chinese developer missed its first payment on such debt

- The recent credit market selloff has been particularly hard on sustainable debt, with a Bloomberg index of environmental, social and governance debt lagging a global bond benchmark over the past year

- Hedge funds are looking for opportunities to buy Sri Lanka’s distressed dollar debt, just as other investors are selling out, on hopes the government may eventually win a bailout from the International Monetary Fund

- The rise in bond yields is beginning to bite, even for the safest global companies, in a sign financing conditions are becoming more challenging

©2022 Bloomberg L.P.