Apr 4, 2024

Colombia Takes Aim at $9 Billion Fund Market Notorious for Huge Fees

, Bloomberg News

(Bloomberg) -- Colombia is seeking to boost competition in a $9 billion financial market notorious for astronomical fees.

The government will change the rules to allow brokerages to offer so-called voluntary pension funds, according to a Finance Ministry official with direct knowledge of the matter.

These vehicles enjoy tax breaks, but annual charges of 3 percentage points are common, even for funds that do little more than track benchmarks such as Colombia’s Colcap, or the MSCI All Country World Index.

The finance ministry’s regulation unit will modify a decree to authorize brokerages to enter this market, said the person, who asked not to be identified as the changes haven’t yet been made public. The rule change is likely to take effect within weeks, the person said.

Despite their name, the voluntary pension funds don’t necessarily have to be used for retirement savings, and money in them can be withdrawn after ten years with no tax penalty. They are separate from the main private pension system, which has about $106 billion under management.

A total of 14 providers including pension fund managers, insurance companies and firms that manage trust accounts known as fiduciarias currently offer voluntary pension funds, whose main selling point is that savers don’t pay income tax on contributions. The nation has 18 licensed stock brokerage firms.

There are 531 registered voluntary pension funds that offer exposure to international and local equity, fixed income, or real estate. Fees can vary depending on the amount invested.

Porvenir S.A., owned by Grupo Aval, charges 3 percentage points a year for a fund that has 69% of its assets in one exchange traded fund managed by Blackrock, the iShares MSCI ACWI. Porvenir didn’t reply to a written request for comment.

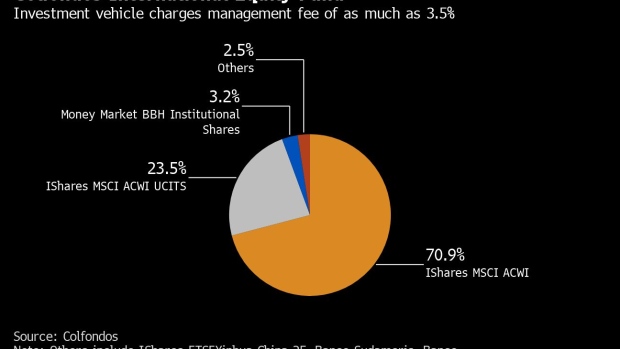

Another fund offered by Colfondos S.A. Pensiones Y Cesantias charges as much as 3.5% per year and has 94% of its assets in that same Blackrock fund, which tracks the MSCI All Country World Index.

Colfondos said in a response to questions that the fund is actively managed and portfolio allocation is the result of a “rigorous analysis process”. Fees range from 1.38% to 3.5% depending on the amount invested, Colfondos added.

One fund offered by Skandia Pensiones Y Cesantias SA holds 96% of its assets in state-controlled oil company Ecopetrol SA, and the rest in liquid local savings vehicles. For this they charge a yearly fee of 2.8% of assets under management.

Over five years, the gap between gross and net returns would be 16%, according to the Skandia’s fact sheet.

Skandia said in reply to questions that management fees are within market ranges for similar options, and that the fund manager offers the support of a financial planner to advise clients in choosing between more than 40 portfolios.

Returns After Fees

In 2020, financial regulators started pushing for more transparency in the voluntary pension market, including forcing the funds to disclose performance compared to a benchmark, and the gap between gross returns and returns after fees.

Alianza Fiduciaria offers a fund that invests in emerging market debt, which has returned 5.2% over the past five years, lagging its benchmark by 12.7 percentage points. Alianza didn’t reply to a request for comment.

In Chile, firms that manage voluntary savings seeking to complement retirement savings charge fees between 0.16% and 0.95% of assets under management, according to data from the nation’s pension regulator.

Separately, Colombia’s congress is debating a reform that seeks to overhaul the obligatory pension system, where the private and public sectors compete for worker contributions.

©2024 Bloomberg L.P.