Apr 15, 2024

Corporate Bond Sales Dry Up in Vietnam as Refinancing Risks Loom

, Bloomberg News

(Bloomberg) -- Vietnamese companies are cutting back on issuing new bonds as yields rise and the government heightens scrutiny on capital markets, a development that’s stirring refinancing risk concerns.

New corporate bond issuance in the Southeast Asian nation shrunk by 46% on-year in the first quarter, with a 67% drop in March alone, according to data from the Vietnam Bond Market Association.

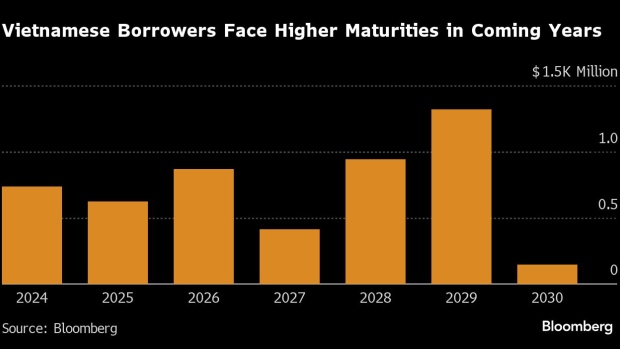

The reduction in new issuance is coming at an inopportune time, when companies are trying to shore up financing amid a post-pandemic recovery. Corporate borrowers’ diminished ability to issue bonds may also crimp their efforts to refinance in a year when about $737 million of bonds are coming due, according to Bloomberg-compiled data.

Bank lending has also slowed down, with Vietnam’s Prime Minister Pham Minh Chinh recently reiterating calls to the central bank to quickly implement “drastic” measures to boost credit growth.

“The large amount of maturity this year and in 2025 is putting a lot of pressure on bond issuers,” said Nguyen Tri Hieu, economist and general director at Toan Cau, a research institute for finance and real estate. “Companies are struggling to seek funding sources as the debt and loan market has been seriously obstructed since the government crackdown.”

In the fall of 2022, the government issued new rules to hold companies more accountable for the use of new bond proceeds, part of a broad enforcement initiative that also resulted in executive arrests.

The rules raised the minimum face value of bonds and required that capital raised must be used as stated. The disclosure portion of the rules also said the issuance purpose must be clearly stated.

The measures seemed to have halting effects on the market. The total amount of new bonds issued in 2022 and 2023 — about 582 trillion dong — was less than half of the total in 2021, according to VBMA’s data.

“This will definitely weigh on the country’s economic growth as most of Vietnamese companies rely on loan and debts to fund their expansion,” Hieu said.

A high-profile trial of billionaire real estate tycoon Truong My Lan in Ho Chi Minh city last week embodied the ongoing market crackdown. Lan was sentenced to death for embezzlement, bribery and violation of bank lending rules. A separate investigation is looking into allegedly fraudulent appropriation of assets from bond issuance tied to her company, Van Thinh Phat Co.

Borrowers are also facing higher costs. With inflation rising in Vietnam this year and the US Federal Reserve’s decision to keep interest rates higher for longer, the yield on the benchmark 10-year government bond jumped 35 basis points in March, the biggest monthly increase since June, according to data compiled by Bloomberg.

“Rising bond yield is also making it more difficult for companies to borrow,” Hieu said, noting the property sector will be hit particularly hard.

©2024 Bloomberg L.P.