Feb 19, 2023

Early BOJ Shift Would Risk Return to Deflation, Ex-Deputy Warns

, Bloomberg News

(Bloomberg) -- The Bank of Japan tweaking its yield curve control before achieving its price goal would risk pushing the world’s third-largest economy back into deflation, former Deputy Governor Kikuo Iwata said, warning the central bank’s incoming leadership against a hasty exit from stimulus.

With sustainable 2% inflation still out of reach, reviewing YCC any time soon would be “extremely dangerous,” Iwata said Sunday on an NHK program, while downplaying the side effects of prolonged easing.

The comments reflect some views that Prime Minister Fumio Kishida’s new central bank governor nominee should take time to assess Japan’s economy before making any drastic changes.

Kishida chose academic Kazuo Ueda in a surprise decision this month, likely tasking him with the difficult mission of ultimately paring back stimulus after a decade of massive easing.

Iwata said he’s concerned that tweaking YCC and leaving the market to determine yields would narrow the rate differential with the US and cause rates to rise.

“That in turn would cause the yen to strengthen too much and put downward pressure on the economy, and place the 2% target further from reach,” said Iwata,who was Haruhiko Kuroda’s deputy during the first five years of his term.

Read More: Japan Nominates Ueda to Head BOJ Amid Pressure for Policy Shift

While inflation in Japan has hit a 41-year high, real wages have continued to decline, only managing a slight gain in December on temporary factors.

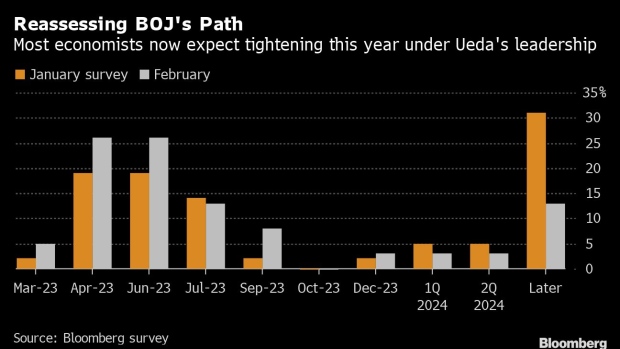

Still, 70% of economists polled by Bloomberg expect the central bank will take a tightening step by July, with more than half seeing the BOJ scrapping its current system of controlling government bond yields as its next move.

As Ueda takes over as BOJ governor, one of the possible changes in focus is a revision of a joint statement between the government and the BOJ. The 2013 accord pledged to hit 2% inflation “at the earliest possible time.”

Last month, a panel of experts recommended making the target a long-term goal, prompting the yen to strengthen as market players interpreted it as further evidence of a policy adjustment under the new leadership.

Former BOJ policy board member Goushi Kataoka, who appeared on the same program as Iwata, warned against rewriting the accord too soon. “It won’t go well if they try to move away from that.”

Read More: Panel’s Call for Rethink of BOJ Accord, Price Goal Moves Yen

When the central bank eventually does tweak YCC, it should shift its target from 10-year yields to shorter-term zones, said Hideo Hayakawa, a former BOJ executive director. This will have a greater impact on the economy and prices, he said, also on the NHK program, noting that Australia targets three-year yields.

©2023 Bloomberg L.P.