Jul 29, 2022

EU Banks Get $3.8 Billion Boost From End of Negative Rates Era

, Bloomberg News

(Bloomberg) -- Banks’ core business of lending has finally turned more profitable again, as the era of negative interest rates in the euro area comes to an end.

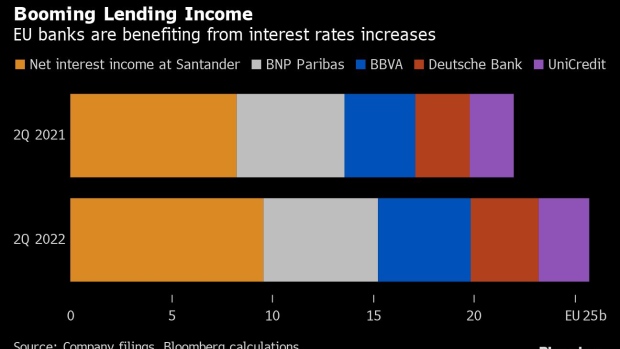

The EU’s five biggest banks that have reported results so far showed an increase in net interest income of 3.74 billion euros ($3.82 billion) on the same quarter last year, a jump of 17%. Their profits beat analyst forecasts across the board, even though credit provisions and expenses generally rose too.

Particularly strong was BNP Paribas SA, which notched its biggest quarterly profit on record, while UniCredit SpA’s net income rose to the highest in almost five years.

A large part of their success is down to the European Central Bank, which exited eight years of negative rates last week as officials confronted the threat of surging inflation, raising its deposit facility to 0%.

The region’s lenders have been anticipating the move, charging more interest on loans to boost their profit margin in recent months. The ECB’s shift is a welcome trend for lenders after a decade of battling with falling income from lending as interest rates were cut to historic lows by central banks.

The ECB took its deposit rate - what it pays banks to hold their money with the central bank - negative in mid 2014 to encourage lenders to boost the supply of cheap credit to companies and consumers. The move supported Europe’s economy and made funding cheaper. But it also turned banking on its head as it prompted lenders to charge their customers to foot the bill for keeping money on deposit with the lending banks.

Inflation is now pushing banks’ costs higher and they are setting aside more money to cope with possible loan defaults due to the worsening macroeconomic outlook, but the impact of those challenges has so far not been too pronounced. The five biggest banks reported a collective 50% jump in quarterly net income. Others banks are yet to report, including Societe Generale SA and Commerzbank AG next week.

The outlook is more muted. Several lenders including Deutsche Bank AG have warned of dire economic consequences if Russia stops supplying gas to Germany. Chief Executive Officer Christian Sewing said on the bank’s earnings call Wednesday that the scenario would drive risk costs up by 0.2% of total loans over this year and next, equivalent to about 1 billion euros.

The end of negative interest rates means banks have to give up the deposit charges they introduced on client accounts. They will also be unlikely to have access to subsidized ECB loans, known as targeted longer-term refinancing operations, that have been an significant source of revenue in the past few years.

There’s a rising tide of politicians that want to tap into banks’ increasing profits to mitigate the escalating cost-of-living crises. Spain on Wednesday unveiled details of a new 4.8% tax on interest and fees charged to clients while Poland is forcing banks - which traditionally charge floating rates on mortgages - to give customers payment holidays on their home loans.

Read More: Bank Relief From ECB Rate Hike Spoiled by Threat of Windfall Tax

That means banks face an uncertain second half of the year, with strong lending profits that could become more of a focus for politicians, as the wider economy looks set to become more challenging.

©2022 Bloomberg L.P.