Sep 28, 2022

Gilt Market Chaos Was Made in UK But Has Lessons for Everyone

, Bloomberg News

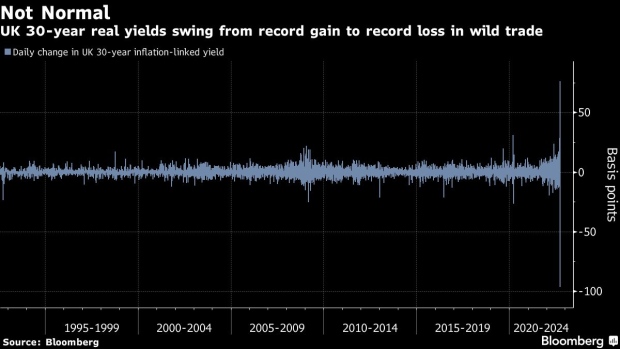

(Bloomberg) -- The UK bond market blowup which forced an unusual Bank of England intervention has shone a light on the fragilities of markets as they transition away from easy money.

While the gilt capitulation was triggered by UK government tax giveaways and exacerbated by quirks in the UK pension industry, the underriding factors were years in the making and global in nature. Major central banks around the world have kept borrowing costs and government finances in check through super-low rates and asset-purchase programs since the global financial crisis.

Now, as inflation forces them to turn off the cash spigots, markets are looking ever more vulnerable.

The situation speaks to the conflict of official mandates, with central banks often tasked to protect against financial instability as well as price pressures. Whether it be the European Central Bank designing an emergency program to tame Italian yields even as it ends its main bond-buying tools or the BOE’s intervention Wednesday, policymakers the world over are set for more headaches.

The UK is “the first to test markets’ resolve by pushing the envelope on fiscal policy against a backdrop of higher rates and shrinking central bank balance sheets,” said Paul Hollingsworth, chief European economist at BNP Paribas SA.

“It may not be the last, however, and thus the UK offers a warning to other governments, such as the one recently elected in Italy.”

Italian Election Threatens to Shatter Quiet in Its Bond Market

Dramatic selloffs in response to policy tightening hints from central bankers are nothing new, with markets throwing what became known as a taper tantrum as long ago as 2013, when then-Fed governor Ben Bernanke mooted cutting asset purchases.

The difference now is that of scale -- the stimulus of the pandemic years was gigantic while global indebtedness levels have ballooned considerably since a decade ago.

“This is a new era,” Jens Nordvig, chief executive at Exante Data Inc., told Bloomberg Television. “We’re really back to the 70s, 80s in terms of the policies being considered here, so brace yourselves for something we haven’t seen for quite a while.”

Quantitative Tightening

This year, most major central banks including the Federal Reserve have raised rates and some have moved ahead with quantitative tightening, where they sell assets they have accumulated over the years.

That two-pronged tightening has caused wild gyrations in rates markets, lifting US yields -- and therefore the cost of capital worldwide -- by more than 200 basis points. Currencies, too, have struggled against the stronger US dollar, which by one gauge is at its highest since records began in 2005.

Clearly, there are UK idiosyncrasies. The BOE said it would temporarily buy long-maturity UK bonds, injecting some desperately-needed confidence into the market as it showed signs of collapsing in the wake of the government’s spending plans.

Adding fuel to the fire were margin calls for so-called liability-driven investment strategies, which are popular among UK pension programs. They often employ leverage to match liabilities -- that stretch decades into the future -- with their assets. The selloff in gilts required many to post more collateral.

The UK Pension Problem That Threatened to Wreck the Gilt Market

The BOE must also contend with the pound, which slumped to a record low against the dollar earlier this week. But with a limited stash of foreign-exchange reserves, it will struggle to conduct an outright currency market intervention, as Japan recently did to lift its yen.

Still, some of the underlying drivers of this week’s British drama -- especially the removal of easy monetary policy -- are far from unique. Some even expect similar volatility in the world’s largest bond market, that of US Treasuries, potentially forcing the Fed into a U-turn.

Money markets are pricing Fed rates peaking around 4.5% next year, more than one percentage point above current levels, while the US central bank this month stepped up the pace at which it lets bonds roll off its balance sheet.

Peter Boockvar, Chief Investment Officer at Bleakley Financial Group, reckons hurdles will emerge.

“We’re witnessing the further unraveling of the grand experiment of central banks over the past 15 years,” Boockvar said.

“It’s easy to think that this is a UK-specific event but be sure that this is coming to a US Fed theater near you if this volatility and violence of bond moves continues. I see now no chance the Fed gets far with QT, let alone much more with rate hikes.”

(Corrects Hollingsworth’s job title in the fifth paragraph.)

©2022 Bloomberg L.P.