Sep 29, 2023

Hong Kong Leads Rally in Asia on Bets Golden Week May Lift Mood

, Bloomberg News

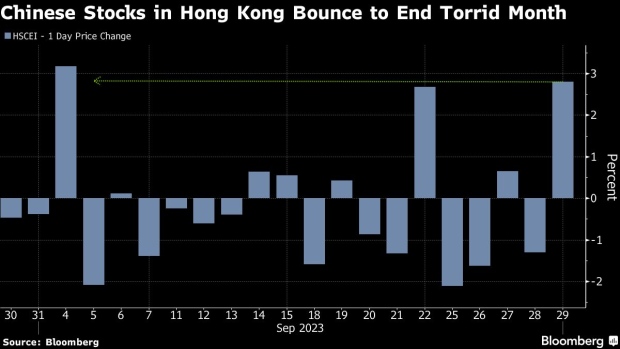

(Bloomberg) -- Asian equities gained, led by a rally in Hong Kong on hopes that China’s Golden Week holiday will spur a consumption revival and boost sentiment marred by the country’s property sector crisis.

The MSCI Asia Pacific Index climbed as much as 0.8%. Friday’s gain helped trim losses for the quarter to less than 4%. The Hang Seng Index and a gauge of Chinese stocks closed over 2.5% higher in Hong Kong trading, with traders citing optimism over Chinese consumption during the peak travel season and dip buying as reasons for the rebound. Mainland markets are closed on a holiday through the end of next week, which pushed turnover on Hong Kong mainboard Friday to the lowest since May.

“It looks like a broad relief rally across the region after a week of declines,” said Marvin Chen, a strategist at Bloomberg Intelligence.

READ: China Traders Hang Hopes on Boost From Golden Week

Activity around Chinese shopping malls remained at relatively high levels in September following an increase in August, according to SpaceKnow, a US company that analyzes satellite images. Stocks of shopping mall operators in Hong Kong climbed in anticipation of greater tourists arrivals from mainland for Golden Week celebrations.

“We are beginning to find a floor from a valuation standpoint and it would not take much good news to start seeing some of these shares move upward,” Derrick Irwin, portfolio manager, Allspring Global Investments LLC told Bloomberg Television. Irwin cautioned that continued weakness in China’s property sector could “further hit the consumers.”

READ: Xi Says China to Step Up Efforts to Meet Annual Economic Goals

The regional benchmark is still set to decline after three straight quarters of gains, lagging behind peers in the US and Europe. China’s deepening property crisis and the higher-for-longer rates narrative have made emerging market assets less appealing to investors. Attention now turns to US core inflation data due later this evening.

Sectors to Watch

- India’s technology stocks fall after global peer Accenture reported its fourth-quarter results and gave a weaker-than-expected outlook, which some analysts see as a negative readthrough for the sector.

- Owners of Hong Kong’s shopping malls including Hang Lung Properties rise on optimism that the city will see a surge in tourists during China’s Golden Week holiday.

- Asian suppliers to Nike rise after the company reported a drop in its stockpile of inventory — a sign it is making progress in moving out older merchandise for newer, more-profitable items.

- Chinese developer stocks such as CIFI Holdings advance after Shenzhen plans to relax the floor for mortgage rates on first-home purchases, the first of China’s four biggest cities to make such a move.

- Paladin Energy and other Australian uranium miners follow shares of overseas peers higher on the prospect of higher power demand in Europe.

Markets at a Glance

- MSCI Asia Pacific Index rises 0.7%

- Japan’s Topix Index fell 0.9%; Japan’s Nikkei Index was little changed

- Hong Kong’s Hang Seng Index rose 2.5%; Hong Kong’s Hang Seng China Enterprises Index rose 2.6%

- Australia’s S&P/ASX 200 Index rose 0.3%; New Zealand’s S&P/NZX 50 Gross Index rose 1.1%

- India’s NSE Nifty 50 Index rises 1%

- Singapore’s Straits Times Index rises 0.5%; Malaysia’s KLCI fell 1%; Philippine’s PSEi fell 1%; Indonesia’s JCI rose 0.3%; Thailand’s SET Index was little changed; Vietnam’s VN Index rose 0.1%

- The yield on 10-year Treasuries declines 3.7 bps to 4.54%

- West Texas Intermediate crude rises 0.4% to $92 a barrel

- Bloomberg Dollar Spot Index falls 0.4%

- Euro rises 0.4% to $1.06

Here Are the Most Notable Movers

- Navin Fluorine declines as much as 14.3%, its biggest fall since March 2020, after the chemicals maker said its Managing Director Radhesh Welling resigned.

- Multi Commodity Exchange of India declines as much as 8.6%, the most since June 30, after the exchange operator said it has been asked by the Indian markets regulator Securities and Exchange Board of India to keep its new commodity derivatives trading platform in “abeyance.“

- Adani Green Energy and Adani Transmission decline as Abu Dhabi-based International Holding Co., which has invested almost $2 billion in Gautam Adani’s conglomerate, plans to sell its stake in the two companies.

- Delta Electronics (Thailand) Pcl tumbles as much as 14% after its parent sold about 89.2 million shares of the Bangkok-listed company at 94.75 baht each in a block trade. The terms of the deal were seen by Bloomberg News.

- Hindustan Zinc rises as much as 5.5%, its biggest jump since July 6, after the mining company said in a statement that it has authorized its committee of directors to evaluate a corporate restructuring exercise.

- New China Life drops as much as 5.3% in Hong Kong after the insurer was downgraded by Morgan Stanley, which cited the sector’s challenges in bond and equity investment returns amid China’s sluggish economy.

- Bloomberry Resorts says it plans to issue up to 559 million new shares at 10 pesos apiece to Quasar Holdings, one of its controlling shareholders.

- Zhejiang Leapmotor Technologies drops as much as 1.3% in Hong Kong after the end of a lock-up period determined in its initial public offering.

Related Market News

- Taking Stock: Whoever wins next month’s general election in New Zealand will inherit one of Asia Pacific’s worst-performing stock markets, with more downside likely ahead.

- Global Wrap: Stocks rose on the last trading day of the quarter and a global bond selloff eased after dovish-leaning comments from Federal Reserve policymakers and reports of a possible meeting between US and Chinese leaders.

- Inside Asia: Most Asian currencies strengthen before the release of the Fed’s preferred inflation gauge — the core PCE index — and as investors position ahead of quarter-end. The Philippine peso leads gains after the central bank signals room for intervention.

Notes From the Sell-Side

- Luxury stocks including LVMH, Hermes, Kering and Richemont all rose at least 2% on Friday after Bank of America strategists raised their view on the luxury sector to overweight, saying recent underperformance now fully reflects an expected slowdown in global business activity.

- Equities are likely to remain sensitive to a “disorderly rates market” even if the third-quarter reporting season shows resilient corporate earnings, according to Barclays strategists.

- Coming off a rough quarter and with clouds hanging over the continent’s economic outlook, stock investors aren’t getting excited about the remaining months of the year — which have historically been strong.

This story was produced with the assistance of Bloomberg Automation.

Story Link: Asian Stocks Gain, Paring Quarterly Loss, as Hong Kong Rallies

©2023 Bloomberg L.P.