Mar 14, 2024

Kenyan Shilling Goes From Laggard to Leader in One Quarter

, Bloomberg News

(Bloomberg) -- Kenya’s shilling has staged a comeback that’s vaulted it from one of the worst to the best in the world in less than three months.

As recently as January 26, the shilling was the third worst performer globally, plumbing a record low versus the dollar. Since then, it has rebounded more than 20%, aided by a mix of factors, including a new eurobond issue. Its year-to-date gain puts it far ahead of the world’s second-best performer — the Sri Lankan rupee — which has strengthened 6.1%.

On Thursday, the shilling firmed 1.4% to trade at 136.79 per dollar as of 2:30 p.m. in Nairobi, its 10th consecutive day of gains.

Read: Kenya Shilling Soars as Locals Ditch Dollars After Eurobond Sale

The shilling’s appreciation “can largely be ascribed to upsized packages from both the International Monetary Fund and World Bank, as well as the issuance of a new eurobond,” said Shani Smit-Lengton at Oxford Economics.

The rebound follows a 21% slide last year, which Smit-Lengton blamed on broad dollar strength, as well as Kenya’s large current account deficit and falling foreign exchange reserves. She now forecasts the shilling will firm to 135.9 per dollar by end-June, before depreciating to 141.0 per dollar by the end of the year.

Other aids to the recent recovery include high interest rates and slowing inflation, which are again making the East African nation attractive to investors, according to Eric Musau, executive director of research at Nairobi-based Standard Investment Bank.

Read: Kenyan Inflation Rate Falls Even Before Currency Rally Registers

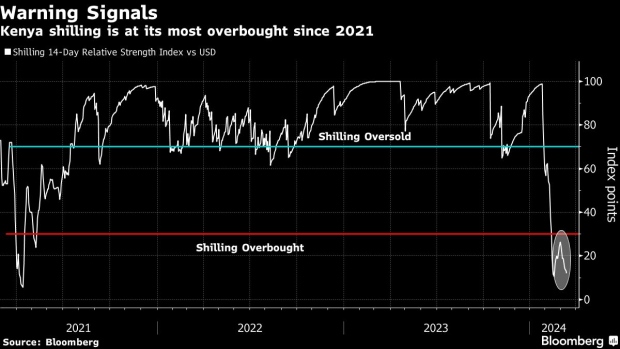

The shilling is currently on track for its best March since 2008, having enjoyed the strongest February advance on record. Those sharp gains over a short period could make the shilling overvalued, some fear. Its 14-day relative strength index — a key technical indicator used in momentum trading - to 11.97, well below the levels that imply a currency is overbought.

Musau still sees the current levels as “sustainable,” but highlighted the need for Kenya to ramp up its foreign currency reserves, which currently are sufficient to fund less than four months of imports.

--With assistance from Colleen Goko.

©2024 Bloomberg L.P.