Apr 15, 2024

Shale-Oil ‘Fracklog’ Resumes Expansion After a Year-Long Hiatus

, Bloomberg News

(Bloomberg) -- Shale explorers are drilling wells faster than they’re fracking them, a signal that US oil-production growth is slowing.

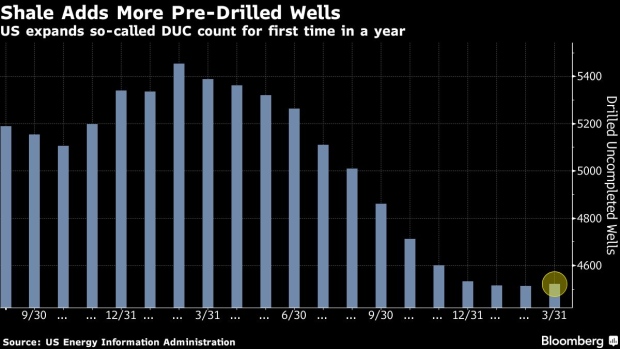

Oil companies added to the number of drilled-but-uncompleted wells, known as the fracklog, last month for the first time in more than a year, according to a report from the US Energy Information Administration on Monday. The tally is a key indicator of near-term crude flows from US shale fields because fracking is one of the final steps in the process of bringing new wells online.

Any slowdown in the US production growth would be a key consideration for OPEC and its allies when they gather in June to decide whether to allow supply curbs to lapse. International crude prices have surged almost 20% this year amid concerns about the potential for global supply shocks, and analysts from JPMorgan Chase & Co. and elsewhere are warning oil may be headed for the $100 mark.

Stockpiling unfracked wells allows drillers to time production for periods of higher prices or easier access to pipelines and other infrastructure. As of the end of March, the fracklog rose by nine to 4,522, according to the government’s assessment of the seven most-important US shale regions.

Overall, US shale-oil output is expected to be steady at about 9.86 million barrels per day in May, below the record 10 million seen in December, according to the report. Output from the Permian Basin hasn’t completely returned to the December high and is expected to be roughly 6.17 million a day next month.

The data will reassure oil bulls who’ve been watching US output closely after efficiency gains helped propel a surprise production boom in 2023. While the number of US rigs drilling for crude has largely remained flat this year, explorers had been eroding the fracklog every month since March 2023, contributing to the unexpected jump in output.

(Adds OPEC+ considerations in third paragraph.)

©2024 Bloomberg L.P.