Mar 13, 2024

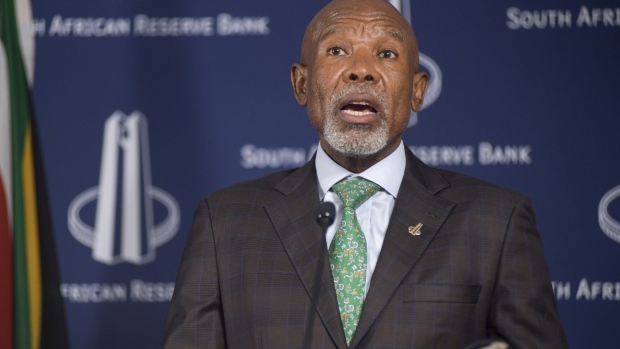

South Africa on Track to Escape Dirty Money List, Kganyago Says

, Bloomberg News

(Bloomberg) -- South Africa should escape an influential global watchdog’s dirty-money monitoring list early next year, the head of the country’s central bank said, while lamenting that it ever ended up there in the first place.

“We feel confident that South Africa will be removed from the grey list by the next review date, in 2025, given the fixes we are implementing,” Governor Lesetja Kganyago told a Financial Sector Conduct Authority conference in Johannesburg Wednesday. “But this has been a costly episode for us. The lesson is that joint efforts are required to look after the integrity of South Africa’s financial system.”

In a harmful knock to its reputation, South Africa was placed on the grey list in February 2023 after the Paris-based Financial Action Task Force identified shortcomings in tackling illicit financial flows and combating terror financing.

The designation followed an era of endemic corruption — referred to locally as state capture — during former President Jacob Zuma’s nine-year rule that’s estimated to have cost at least 500 billion rand ($26.8 billion) in taxpayer funds.

Going on the grey list means that financial transactions with a South African component are subject to enhanced due diligence.

A FATF report showed South Africa has addressed five of the 22 action items, but tackling all 17 of the remaining items by February 2025 remains challenging, the National Treasury said last month.

Kganyago, in his Wednesday speech, noted the resilience of the South African banking sector during the recent stress of the Covid-19 pandemic. But he also cautioned that it suffered from a public image problem with people ready to believe the worst of their bankers, referencing alleged rigging of the rand that penetrated the popular discourse despite no evidence of a general conspiracy.

“Public trust in the financial system is not as deep as it needs to be,” he said. “I worry about our ability to have well-informed policy conversations, in potentially more stressful circumstances, if bad analysis can get this kind of public reaction.”

The speech was mainly focused on financial conduct though Kganyago did reiterate that inflation remains sticky and monetary policy will need to remain tight.

“We have significantly higher inflation, and although headline numbers are coming down, underlying inflation is still quite sticky,” he said. “Interest rates are staying higher for longer.”

©2024 Bloomberg L.P.