Jun 4, 2019

Stocks jump most since January on jolt from U.S. Fed's Powell

, Bloomberg News

BNN Bloomberg's closing bell update: June 4, 2019

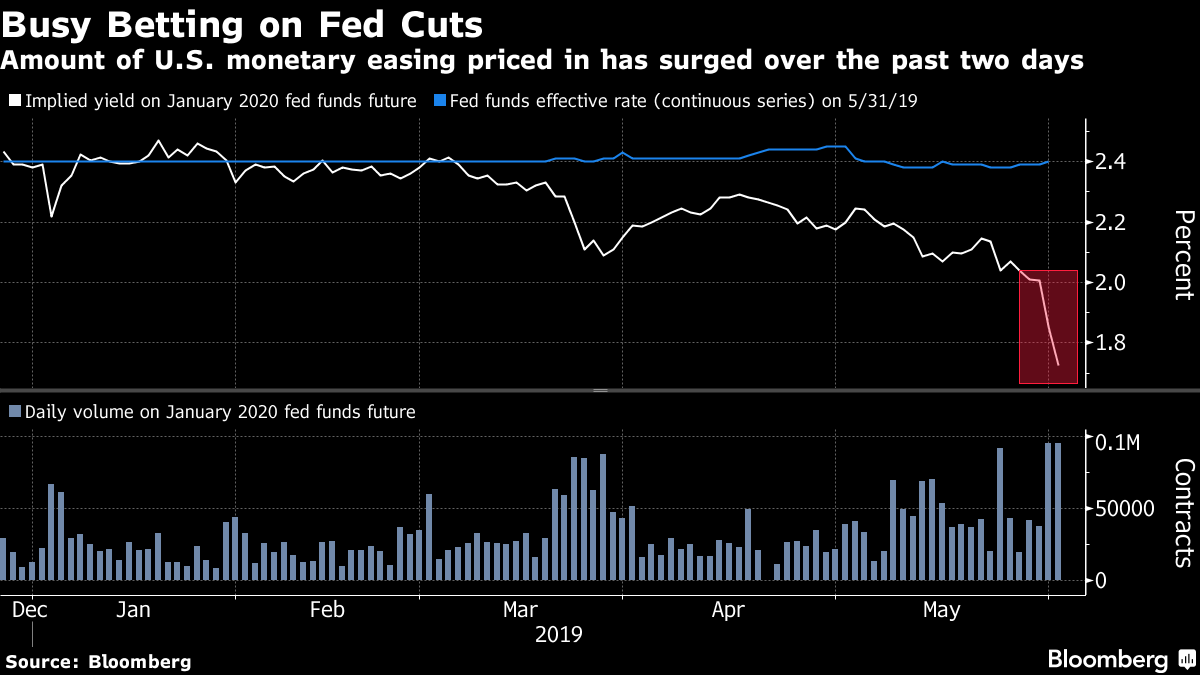

U.S. stocks climbed the most since January as Federal Reserve Chairman Jerome Powell signaled an openness to rate cuts and and Mexican officials said they expect to avoid Trump administration tariffs.

Big banks surged as Wells Fargo analyst Mike Mayo said the industry would be set to “party like it’s 1995” if rates are cut. Treasury yields rose from multiyear lows as Powell stopped short of signaling an imminent move. Carmakers and chip manufacturers rallied as Mexico’s president said he hopes to reach a deal with the U.S. before next week’s deadline, with his foreign minister seeing 80 per cent odds to negotiate a solution. The peso jumped.

Later in day, the Washington Post reported that Republican senators warned Trump administration officials they were ready to block efforts to impose duties on Mexican imports. The tariffs would compound the effects already filtering through the economy from the levies on Chinese imports over the past year. U.S. growth was already poised to slow to about 2.6 per cent this year and further slide to 1.9 per cent in 2020, according to economists surveyed in early May.“Given the ongoing uncertainty on both the interest rate and trade front, any clarity will likely be welcomed by the market,” said Mike Loewengart, vice president of investment strategy at E*TRADE Financial. “A lot of market-watchers will be reading the tea leaves from this week’s jobs data, which could hold significant weight for the Fed’s next rate move.”

Continued strength in U.S. consumer and business confidence outweighs the recession signal being sent by an inverted yield curve -- making a rate cut unlikely this year, according to Bank of America Chief Executive Officer Brian Moynihan. He also said that the ongoing trade war isn’t having enough of an impact to warrant recession concern.

Elsewhere, gains in automakers and banks pushed European stocks higher for a second day. Oil rebounded as signs of tightening supply from OPEC+ temporarily overshadowed concern over global demand. Bitcoin fell as much as 12 per cent.

Here are some notable events coming up:

China President Xi Jinping begins a two-day visit to Russia on Wednesday. Theresa May steps down on Friday as leader of the Conservative Party. Friday’s U.S. jobs report is projected to show payrolls rose by 180,000 in May, unemployment held at 3.6 per cent, a 49-year low, and average hourly earnings growth sustained a 3.2 per cent pace.

These are some of the main moves in markets:

Stocks

The S&P 500 Index surged 2.1 per cent to 2,803.27 as of 4 p.m. New York time. The Stoxx Europe 600 Index climbed 0.6 per cent. The MSCI Asia Pacific Index gained less than 0.05 per cent.

Currencies

The Bloomberg Dollar Spot Index fell 0.1 per cent. The euro advanced 0.1 per cent to US$1.1257. The British pound gained 0.3 per cent to US$1.2707.

Bonds

The yield on 10-year Treasuries jumped five basis points to 2.12 per cent. Germany’s 10-year yield declined less than one basis point to -0.21 per cent. Britain’s 10-year yield jumped four basis points to 0.902 per cent.

Commodities

The Bloomberg Commodity Index advanced 0.3 per cent to 77.71. West Texas Intermediate crude advanced 0.6 per cent to US$53.57 a barrel.