Apr 9, 2024

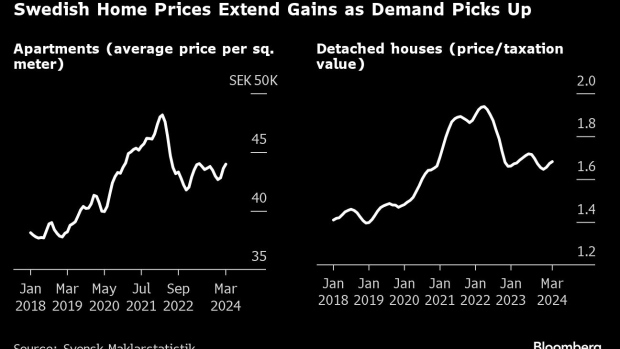

Swedish Home Prices Extend Gains as Market Shows Signs of Thaw

, Bloomberg News

(Bloomberg) -- Swedish housing prises rose for a second month in March and sales numbers perked up, suggesting that expectations of a near-term cut in interest rates are giving a boost to the recently-ailing market.

Apartment prices rose by 1.8% in March from the prior month, while the average price of detached houses increased by 1.1%, according to data published Tuesday by Svensk Maklarstatistik, which is owned by the Association of Swedish Real Estate Agents. That follows gains of 0.4% and 0.5%, respectively, in February.

“The March figures show a thaw with more deals and increased prices,” the association’s chief executive, Oskar Oholm, said in a statement, adding “there may still be setbacks.” Also, the closing prices are now on average “just above” the starting bids, he said.

The number of homes sold during the first three months of 2024 rose 8% from a year earlier to 37,100, with gains driven by single-family houses, up 12%. The transaction volume for flats increased by 7%.

Swedish households, among some of the most indebted in Europe, have turned less gloomy in the past months as slowing inflation has helped restore purchasing power. An added boost came from the central bank which last month signaled that the benchmark interest rate may be cut as early as May. A housing-price indicator from Sweden’s largest lender SEB AB published Monday also showed more than half of the respondents now believe prices will gain.

Read More: Most Swedes Are Bullish on House Prices as Riksbank Signals Cut

--With assistance from Niclas Rolander and Joel Rinneby.

©2024 Bloomberg L.P.