Apr 10, 2024

Thailand to Fund $14 Billion Cash Handout Through State Budget

, Bloomberg News

(Bloomberg) -- Thailand will fund a $14 billion cash handout program to stimulate the economy through a combination of state budget and assistance from a state bank, shelving an earlier plan to resort to a one-time borrowing.

The financing details of the so-called digital wallet program — which will see 50 million adult Thais each getting 10,000 baht ($275) — were approved by a panel headed by Prime Minister Srettha Thavisin in Bangkok on Wednesday. The cash stimulus, equivalent to about 2.9% of gross domestic product, is set to be implemented in the fourth quarter.

Under the financing plan, a total of 327.7 billion baht will come from the budgets for this fiscal year and the next, Lavaron Sangsnit, permanent secretary at the Finance Ministry, told reporters. The remaining 172.3 billion baht will be carved out of state-owned Bank for Agriculture and Agricultural Cooperatives’ budget and the lender will pay the money directly to about 17 million farmers.

The cash stimulus will add about 1.2 to 1.8 percentage points to the nation’s gross domestic product and lift growth in 2025 to near 5% in 2025, according to the finance ministry. The program will adhere to the nation’s Fiscal Discipline Act and guarantee economic and social stability, it said in a statement.

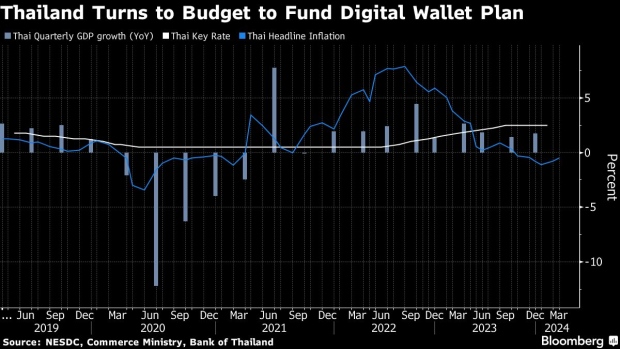

The stimulus, delayed by several months over differences on how it will be funded, is touted by Srettha as key to lifting growth in Southeast Asia’s second-large economy that’s lagged the pace of its peers in the region. Some central bankers and opposition parties have opposed the payout, arguing it may fan inflation and widen public debt.

“The government deems it crucial to stimulate the economy through the digital wallet program to inject cash into the economy and distribute it to local communities,” the finance ministry said. “The Thai economy currently faces internal and external challenges such as geopolitical issues and an uneven post-Covid recovery in people’s incomes.”

The money is to be spent on goods within a specific time-frame in a designated area and is the flagship pre-election promise of Pheu Thai Party that leads the current coalition government. The cash cannot be spent on alcohol, cigarettes, fuel and goods bought online.

The stimulus measures, including the digital wallet, are “extremely necessary” as the Thai economy is coming off a decade of average sub-2% growth and faced other problems including uneven economic recovery post the pandemic and high interest rates, Srettha has said.

BOT Concerns

But the Bank of Thailand, which had called for the stimulus to be more targeted at the vulnerable sections of the society, said it still had some concerns about the program. While the source of funding is clearer now, it needs to be seen “whether the government can achieve that funding,” Assistant Governor Chayawadee Chai-Anant told reporters.

BOT is also worried about the effectiveness of the stimulus and security of the digital payment system, she said.

Srettha, who also doubles as the finance minister, is pushing for looser fiscal policy settings to lift the nation’s $500 billion economy from a decade of average sub-2% growth. Last week, the cabinet approved a plan to widen the budget deficit for next year by about $4.2 billion and the parliament may hold a special session in the next two months to accelerate approvals for the spending plans.

On Tuesday, the cabinet also announced a raft of incentives and tax breaks for the property sector that officials say will further aid the economy.

The stimulus measures being funded through debt risks a setback for its fiscal consolidation efforts though it’s likely to support growth in the near-term, ratings companies have warned. The baht has gone from the best-performing Asian currency in the fourth quarter last year to the biggest loser this year as investors continue to pull funds out of the nation’s equities and bonds.

(Updates with central bank comments from ninth paragraph.)

©2024 Bloomberg L.P.