Feb 25, 2022

U.S. consumer spending tops forecasts even as inflation jumps

, Bloomberg News

Inflation hits 31-year high

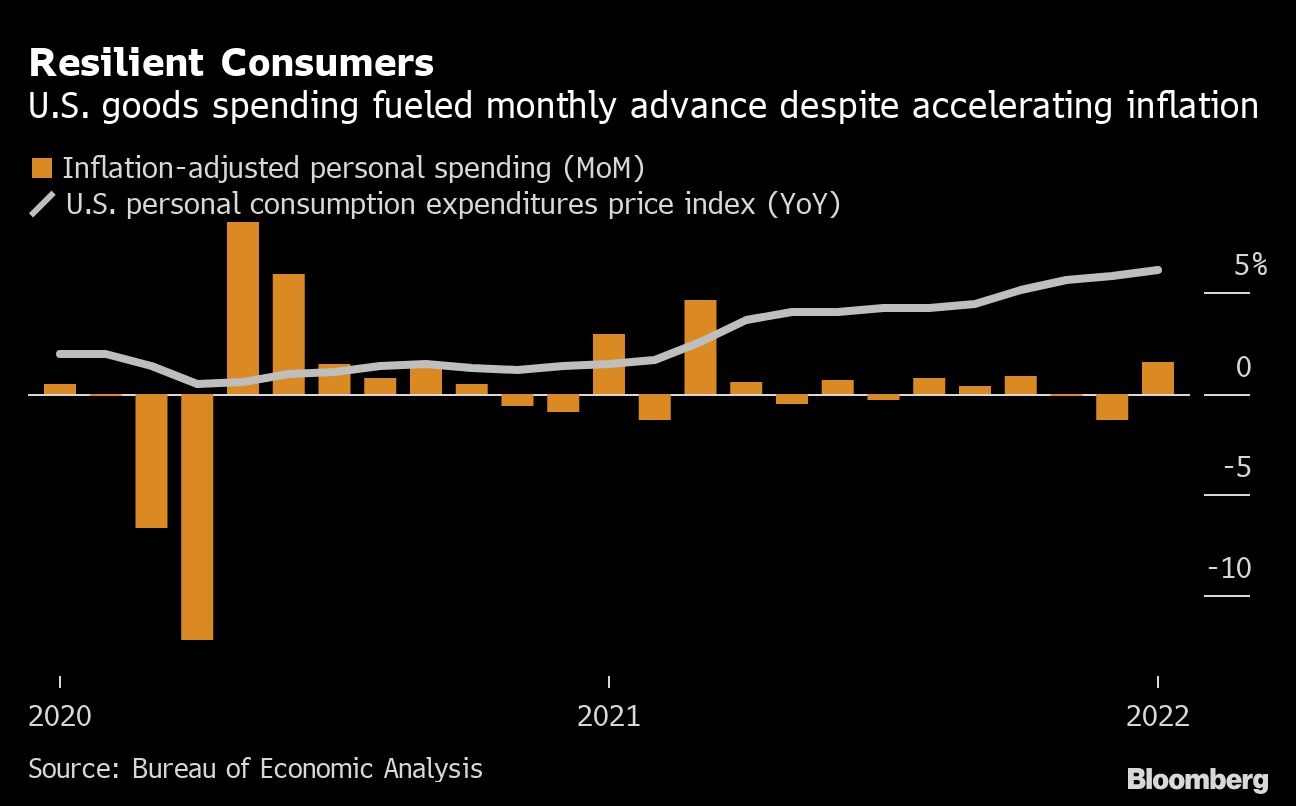

U.S. inflation-adjusted consumer spending advanced by more than expected in January, highlighting the resilience of American demand despite a surge in COVID-19 cases and prices rising by triple the Federal Reserve’s target.

Purchases of goods and services, adjusted for changes in prices, increased 1.5 per cent from December, the most in 10 months, according to Commerce Department figures Friday.

The personal consumption expenditures price index, which the Fed uses for its inflation target, increased 0.6 per cent from a month earlier and 6.1 per cent from January 2021, the most since 1982. Unadjusted for inflation, spending rose 2.1 per cent from December, while incomes were little changed.

The report underscores the robustness of consumer demand and reflects the temporary, but relatively subdued, impact from the omicron wave on outlays. Declining COVID-19 cases and an improving labor market should support spending in the months ahead, especially for services, but inflation -- which is expected to increase further in the near term -- remains a headwind.

The personal saving rate fell to an eight-year low in January as child tax-credit payments lapsed and spending was strong.

The latest hot inflation print further validates Fed officials’ calls to begin raising interest rates at their March policy meeting and could potentially lend support to a half percentage-point hike, rather than a quarter point. However, the Russian invasion of Ukraine, which is poised to worsen the inflationary picture, has injected uncertainty into the global economic outlook.

A separate report Friday showed orders placed with U.S. factories for business equipment rose in January by the most in four months, exceeding forecasts and consistent with resilient capital spending and pointing to steady manufacturing growth.

The median forecasts in a Bloomberg survey of economists called for a 1.2 per cent increase in inflation-adjusted spending from the prior month and a 6 per cent rise in the price index from a year ago.

Inflation-adjusted goods expenditures jumped 4.3 per cent from the prior month, while spending on services rose just 0.1 per cent, according to Friday’s data. Figures earlier this month showed retail sales rebounded in January from an end-of-year slump, but record COVID-19 infections kept many Americans at home and curbed outlays on services like dining out.

Meantime, personal incomes stagnated in January, as the end of monthly child tax-credit payments offset a 0.5 per cent advance in wages and salaries. The program gave millions of families up to $300 per child each month.

As a result of that policy change -- which the Biden administration had hoped to avoid before its Build Back Better package stalled in Congress -- disposable personal income, adjusted for inflation, fell 0.5 per cent. That was partly offset by higher Social Security payouts, as millions of retired Americans received a 5.9 per cent cost-of-living adjustment starting in January, the largest bump in four decades.

Overall, that pushed the saving rate -- or personal saving as a share of disposable income -- down sharply to 6.4 per cent, an eight-year low, from 8.2 per cent.

The core PCE price index, which excludes food and energy and is often seen as a more reliable guide to underlying inflation, rose 5.2 per cent from a year earlier, the most since 1983.