Feb 15, 2023

US Factory Output Rises by Most in Nearly a Year in Broad Gain

, Bloomberg News

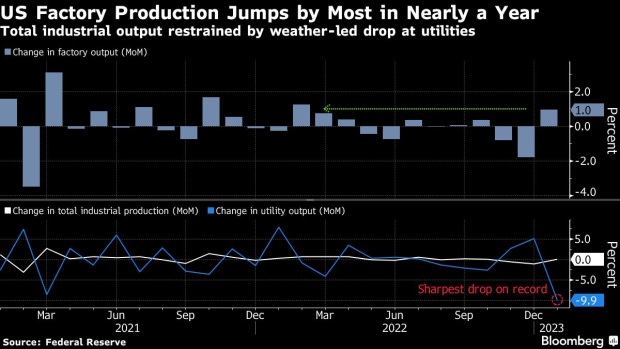

(Bloomberg) -- Output at US factories rose in January by the most in nearly a year, suggesting improving supply chains and firmer demand are offering some relief for a still-challenged manufacturing sector.

The 1% increase last month in factory production — the most since February 2022 — followed a downwardly revised 1.8% decline in December, according to Federal Reserve data released Wednesday. Including mining and utilities, total industrial output was unchanged in January, restrained by unseasonably warm weather that depressed demand for heating.

The median forecast in a Bloomberg survey of economists called for a 0.8% increase in manufacturing production and a 0.5% gain in total output.

The increase marks a welcome respite for factories who dialed back output significantly during the final two months of last year in the face of softer demand.

While separate data Wednesday showed a sharp rebound in retail sales in January, manufacturers still face a number of headwinds that include a tepid global economy, elevated inventory levels and risks of a pullback in capital investment as interest rates rise.

The figures stand in contrast with survey data from the Institute for Supply Management that showed a gauge of factory activity shrank for a fifth month to the lowest level since May 2020.

The Fed’s report also showed capacity utilization at factories rose to 77.7%. In December, the capacity rate slid to 77.1%, the lowest in over a year.

The gain in manufacturing output last month was fairly broad, including increases in machinery, motor vehicles, electrical equipment and appliances as well as computers. Excluding autos, factory production climbed 1%, the most in nearly a year.

By market group, output of consumer durable goods, business equipment and construction supplies all increased.

Utility output slumped a record 9.9%, while mining increased 2%, the most since March. Oil and gas well drilling fell for a third month.

--With assistance from Chris Middleton, Augusta Saraiva and Reade Pickert.

(Adds graphic)

©2023 Bloomberg L.P.