Apr 9, 2024

Aareal Reduces Non-Performing US Office Loans by €500 Million

, Bloomberg News

(Bloomberg) -- Aareal Bank AG said it reduced the volume of non-performing US office loans by about €500 million ($543 million) as it moves to contain the fallout from deteriorating real estate markets.

The reductions took place in the first quarter, a spokeswoman said in response to a Bloomberg query. She declined to provide any details on the measures taken by the German real estate lender.

Aareal said in February that it booked provisions to reduce some non-performing US office loans through what Chief Executive Officer Jochen Kloesges called “a bouquet of instruments.”

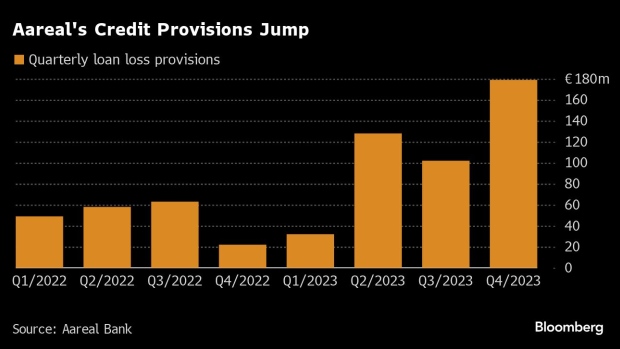

Aareal Bank’s exposure to US commercial real estate took the spotlight earlier this year after several lenders with large volumes of loans in the sector set aside more money to cover potential losses. Aareal’s risk provisions in the final quarter of last year amounted to €179 million ($194 million), a roughly eightfold increase on the previous year’s period.

Property markets are under pressure as higher interest rates saddle owners with surging borrowing costs and plunging valuations. US office buildings have been particularly hard hit as workers are slow to return to offices, leaving some investors struggling to service their debt.

Aareal, which is backed by investors including Advent International and Centerbridge Partners, has said it expects the environment in the US office property market to remain challenging this year.

©2024 Bloomberg L.P.