Jun 1, 2022

As Recession Looms, UK Markets Clash With BOE Stance on Interest Rates

, Bloomberg News

(Bloomberg) -- A clash is brewing between markets and the Bank of England.

As a recession looms over the economy, the central bank has signaled it’s wary of tipping the UK over the edge by moving too aggressively. But money market traders are holding tight to bets for a rapid tightening.

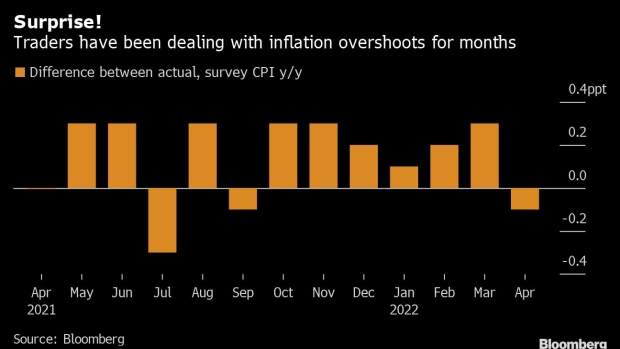

It’s putting a spotlight on the challenge facing BOE officials, who say they’re treading a fine line to keep the economy on track. But with inflation running so hot, investors argue that policy makers don’t have the luxury of being cautious and need to risk crashing the economy to stop price pressures from spiraling out of control.

“There is a dichotomy between BOE guidance and rate-market pricing,” said Imogen Bachra, a rates strategist at NatWest Markets Plc. “The market perceives the BOE to lack credibility.”

Part of the reason there’s such a big gap between the BOE and market pricing is that economic signals have been confusing. While fears of a recession are growing, the labor market is at its strongest in living memory. Add to that the UK government’s £15 billion ($19 billion) aid package, which may help the economy, but also stoke inflation.

In a conference panel last month, BOE Governor Andrew Bailey highlighted the UK’s sluggish growth rate and said policy makers would have to take it into account when making decisions. Analysts have viewed remarks like that as a sign that Bailey may go slower on rates.

But market pricing doesn’t reflect it. Bets on interest rates show traders are positioning for the sharpest increase in decades. The market is indicating a 25-basis-point increase in each of the next five meetings, on top of the benchmark rate of 1%. That would imply a 2 percentage points for the year in total, which hasn’t happened since 1989.

Top UK Economist Defends BOE’s Handling of Inflation Crisis

“When inflation is so high and so hot, being dovish has very little credibility,” said Rohan Khanna, a strategist at UBS Group AG.

The UK’s situation stands in contrast with the US, where traders have pulled down their rate expectations by about 25 basis points since early May. Fed Bank of Atlanta President Raphael Bostic said a September pause on hikes “might make sense” if inflation cools. In the UK, they’ve barely moved.

“There’s more uncertainty over the growth backdrop and the market is saying: what does it mean for BOE?” said Francis Diamond, a strategist at JPMorgan Chase & Co. “Its balancing act has become much more precarious.”

Strategists say the difference is that UK inflation is harder to fix and largely beyond the control of the central bank. Energy prices have skyrocketed because of the war in Ukraine, and Brexit has worsened labor shortages, pushing wages higher. The consumer price index rose 9% in April, the highest in the data dating back to 1989.

It’s not just speculators bracing for hikes. Companies are also asking for more options structures that offer protection from higher rates, according to James Bucknall, head of sterling rates trading at NatWest Markets.

In the eyes of BlueBay Asset Management’s Mark Dowding, it’s the BOE’s position that inflation will be able to eventually cure itself, with higher prices reining in consumer demand, that’s most worrying. He’s underweight UK assets including the pound, and says the longer that high inflation persists, the harder it’ll be to get under control.

“The BOE has said it is helpless to control inflation, but I would disagree,” Dowding said. “All UK assets could be under pressure during a stagflationary period.”

©2022 Bloomberg L.P.