Feb 15, 2022

Baillie Gifford Funds Saw Worst Outflow on Record in January Amid Tech Rout

, Bloomberg News

(Bloomberg) -- Investors pulled a record amount from Baillie Gifford’s U.K.-domiciled funds last month as its once-lucrative bets on tech giants continued to decline, according to new data.

The Edinburgh-based fund house lost a total of 10% from its U.K. funds in January, taking the total down to 56 billion pounds ($75.6 billion), data from research firm Morningstar showed. While most of this was due to poor performance, Baillie Gifford also suffered a rare month of outflows, with clients withdrawing a net 875 million pounds, according to the data.

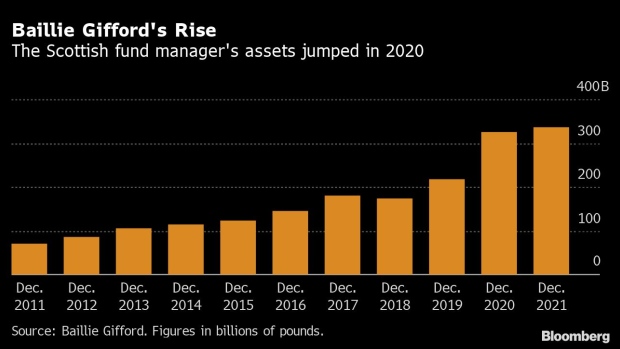

Baillie Gifford, which managed a total of 336 billion pounds ($455 billion) at the end of last year, has stakes in a number of tech names that soared in recent years before suffering large drops over the past few months.

The firm is the largest investor in vaccine producer Moderna Inc. and biotech company Illumina Inc., and its funds are a top-10 shareholder in Zoom Video Communications Inc., e-commerce firm Shopify Inc. and Netflix Inc., according to data compiled by Bloomberg. All of those stocks have slumped at least 25% since the end of August, as nervous investors exit growth equities and brace for tighter monetary policy in the aftermath of the pandemic.

Clients withdrew more than 200 million pounds from Baillie Gifford’s previously popular American Fund in January, according to Morningstar, after its value shrank by almost 40% in the past year to less than 5 billion pounds.

The European fund, which manages 2.68 billion pounds according to data compiled by Bloomberg, has also suffered. Clients pulled about 100 million pounds last month, the Morningstar figures show, following an 18% decline in performance over the past year.

Longer term investors are still sitting on gains, though, with some of Baillie Gifford’s funds up more than 10% over the past three years, data compiled by Bloomberg show.

Baillie Gifford declined to comment on the figures.

The company is trying to reassure customers, who include major U.S. pension funds as well as British municipalities and individuals, about the market declines. “We were neither heroes in 2020 nor villains in 2021,” Baillie Gifford wrote in a letter to investors in January, adding that it won’t divert from its “tried and tested” long-term investment strategy.

“It makes no real sense that Zoom can increase its sales by 30% and see its price drop by 40%,” James Budden, director of marketing and distribution at Baillie Gifford, told Bloomberg News earlier this month. “Calm will return at some stage and we will all move on.”

©2022 Bloomberg L.P.