Apr 9, 2024

Bets on Intervention Fuel Yen Buying by Japan’s Retail Investors

, Bloomberg News

(Bloomberg) -- As the yen trades near a 34-year low, speculation over possible intervention is consuming Tokyo’s currency markets. One group is confident it will happen — domestic retail investors.

In contrast to professional asset managers who have record short positions, Japanese retail investors are betting that the government will step in to push up the yen. The currency could rapidly strengthen by as much as 5 yen against the dollar in such a scenario, according to market strategists.

They are counting on Japan’s Finance Minister Shunichi Suzuki, who has repeatedly warned of his willingness to address excessive moves in the currency. As the yen approaches the 152 level, speculation has risen that crossing that threshold will trigger action.

“Investors are anticipating intervention, and the closer the yen approaches 152 yen, the more their dollar selling positions swell,” said Takuya Kanda, the head of research at Gaitame.com Research Institute.

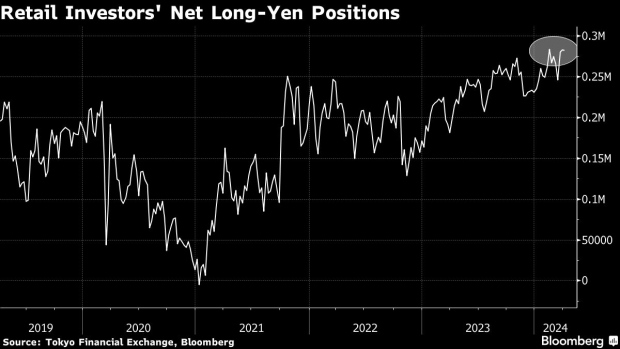

Japan accounts for nearly 30% of global currency trading by retail investors, according to the Bank of Japan. Long-yen positions held by Japanese retail investors were close to a record level on April 2, according to Tokyo Financial Exchange’s Click 365’s exchange-traded foreign exchange margin (FX) market.

That stands in stark contrast to financial professionals. According to the latest data from the Commodity Futures Trading Commission (CFTC), net shorts of the yen held by leveraged funds and asset managers rose to 148,388 contracts in the week ended April 2, the highest level since January 2007. Investors have been selling yen positions in anticipation of a further depreciation of the yen due to the widening interest rate gap with the U.S.

So far, the professionals have been right. The yen has lost about 7% this year against a broadly advancing dollar, making it the weakest major currency. The Bank of Japan’s first rate hike since 2007 has failed to stop the slide.

Still, the government has ample power if it chooses to act. Japan’s foreign-exchange reserves stood at $1.15 trillion at the end of February. The Ministry of Finance spent more than ¥9 trillion ($59 billion) in three occasions in September and October 2022.

Being on the other side of the trade is making some professionals nervous.

“We have a buy-dollar position at a level close to 152 yen as customers sell dollars,” said Yoshio Iguchi, head of the market department at Traders Securities, which covers customers’ trades in the market. He added that they are prepared to immediately cover those positions if the threshold is breached.

“We are afraid of currency intervention,” he said.

©2024 Bloomberg L.P.