Feb 11, 2023

Credit Markets Are Poised for a Gut Check After 10% Rally

, Bloomberg News

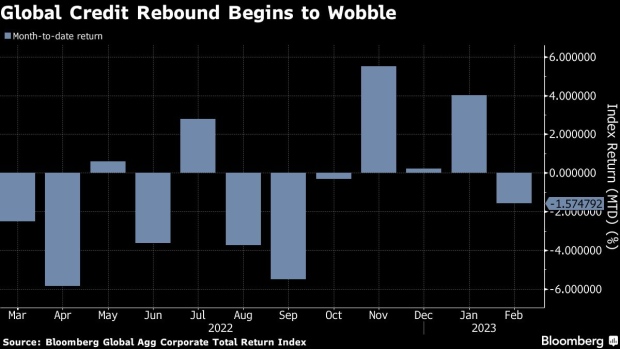

(Bloomberg) -- After rallying for the past three months, the mood is starting to shift in global credit markets.

Despite a selloff during the past week, a Bloomberg index tracking investment-grade corporate debt is still up 10% since the market bottom in October. And the premiums on new bond offerings in the US to Europe have largely vanished in the past few weeks. But now money managers and strategists are calling for a gut check.

“The low hanging fruit has been collected,” Maria Staeheli, a senior portfolio manager at Fisch Asset Management in Zurich, told Bloomberg’s Tasos Vossos in an interview this past week. “It has been evident for the past couple of weeks” that opportunities in new issues in particular “are getting very close to fair value.”

One concern lately is whether debt investors are paying too little attention to the risk that policy makers fail to tame inflation and are forced to boost interest rates more than expected.

Hawkish comments from Federal Reserve officials and a surprise jump in US used-car prices fueled those worries this past week, sparking a 1.25% loss in Treasuries, the worst in three months. Adding to the warning signs, Treasury yield curves became even more inverted, and Bloomberg Economics models are showing a high risk of a recession in the US. Yet corporate bond spreads over government debt widened just two basis points.

“While it is difficult to identify a specific catalyst that will drive material near-term widening, we think that the risk-reward for credit has worsened following the recent rally,” Barclays strategists led by Brad Rogoff wrote in a note Friday.

JPMorgan Chase & Co. strategists in London warned earlier that strong gains in Europe’s credit market may ultimately trigger a move by central bankers to reign in liquidity.

“After four months of calling for tighter spreads, we are starting to feel a bit nervous,” strategists led by Matthew Bailey wrote.

Amid that tension, companies have been rushing to borrow while they can.

Ten companies sold $8.5 billion of new debt in the US high-yield bond market this past week, from American Airlines to Royal Caribbean Cruises, mostly to refinance debt. Even in the leveraged loan market, which had largely been shut until recent weeks, about $5.9 billion of deals priced.

Libor’s Demise Forestalled

This is supposed to be the year that trillions of dollars in assets, from mortgages to corporate loans, finally shed the scandal-plagued benchmark known as the London interbank offered rate (Libor). But as Bloomberg’s Paula Seligson reported this past week, it’s proving to be anything but routine.

Roughly three-fourths of the $1.4 trillion US leveraged loan market still needs to flip to SOFR, or the Secured Overnight Financing Rate, to meet a deadline of the end of June to transition from Libor.

But lenders have rejected a string of amendments that would have flipped the benchmark on some existing loans because they’re haggling over what’s called a “credit spread adjustment,” an additional handful of basis points meant to compensate for how Libor typically prints above SOFR. In recent weeks, lenders have successfully blocked proposed adjustments that they saw as too low from sports and news broadcaster Sinclair Broadcast Group, pet food firm Wellness Pet Co., ticket resale company Viagogo Entertainment Inc. and communications equipment business CommScope Inc.

Elsewhere:

- Korea’s resurgent credit market saw the largest won-denominated corporate bond offering in at least a decade as SK Hynix sold 1.39 trillion won ($1.1 billion) of notes. The memory chipmaker received more than 2.5 trillion won of orders for the debt, a company filing showed.

- Investment banks including JPMorgan Chase & Co. are approaching investors to gauge their interest in bond sales by Chinese developers after a yearlong deal drought. The banks have been encouraged after Dalian Wanda Group’s property arm completed its second sale in the past month, a sign that investors are willing to lend to higher-quality firms in the sector.

- After being underweight Chinese developer bonds for more than a year, BEA Union Investment Management Ltd. is buying the debt again and said it still offers “the most attractive buying opportunities” in China’s credit market. That’s even after the debt racked up huge gains in recent months.

- Texas’ war against ESG-friendly banks has cost Citigroup a piece of the state’s biggest-ever municipal bond deal. The New York-based bank, which Texas’ state attorney general said “discriminates” against the firearms industry, was dropped from the $3.4 billion offering, which will raise money to bail out natural gas utilities stung by financial losses from a deadly 2021 winter storm.

--With assistance from Jill R. Shah, Wei Zhou, Tasos Vossos, Caleb Mutua, Paula Seligson and Dana El Baltaji.

©2023 Bloomberg L.P.