Jul 29, 2022

Europe’s Stellar Growth Is Already Unraveling as Inflation Jumps

, Bloomberg News

(Bloomberg) -- Europe’s bumper economic growth is already buckling under the weight of record-breaking inflation and the increasing likelihood of a Russian energy cutoff.

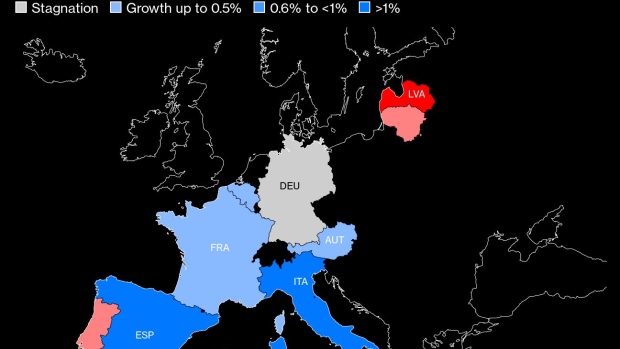

Second-quarter output in the 19-member euro zone surged by more than three times the amount analysts expected, with Italy, Spain and France topping estimates by some distance.

But Friday’s data also underlined the challenges: There were contractions for Portugal and the Baltic region, while Germany, the continent’s No. 1 economy, unexpectedly stagnated and may be headed for a recession. Euro-area consumer prices hit a fresh all-time high.

Figures earlier this week showed confidence gauges slumping and a second straight quarter of economic contraction in the US. Anticipating weaker growth, traders have pared wagers on interest-rate hikes by the European Central Bank.

What Bloomberg Economics Says...

“For now, the impulse created by Europe’s re-opening and significant fiscal support are trumping the downdraft from the energy crisis. July inflation also topped expectations, but the full impact of Russia throttling Europe’s gas supply is yet to be felt. Add in tighter financial conditions and a sharp slowdown looks inevitable.”

--Jamie Rush, chief European economist. For full REACT, click here

Europe’s outlook for the coming months is extraordinarily uncertain. While the summer tourism season is handing southern countries a boost, projections beyond that are being downgraded as the Kremlin’s energy threats, lingering supply snarls and the cost-of-living crisis depress demand and output.

Far from Europe’s economic engine, as in the recent past, the International Monetary Fund said this week that Germany is set to be this year’s laggard among the Group of Seven nations due to the reliance of its outsized industrial sector on Russian natural gas.

©2022 Bloomberg L.P.