Feb 17, 2022

Fed Needs to Hike to Slow Inflation Without Recession, Credit Suisse Strategist Says

, Bloomberg News

(Bloomberg) -- The Federal Reserve needs to pursue a Volcker-style shock strategy to drive down asset prices if it wants to slow inflation without causing a recession, according to Credit Suisse Group AG strategist Zoltan Pozsar.

The central bank needs to curb services inflation, which is driven up by higher housing costs and a reduced labor supply, Pozsar wrote in a note to clients. The key to turning those drivers around is to tighten financial conditions by increasing longer-term borrowing costs, the influential analyst said.

“We need to slow services inflation by slowing, not killing, wage growth, by bringing about more supply of labor, not less demand for it via a recession,” Pozsar said. “Mortgage rates need to get higher and house prices flat or outright lower.”

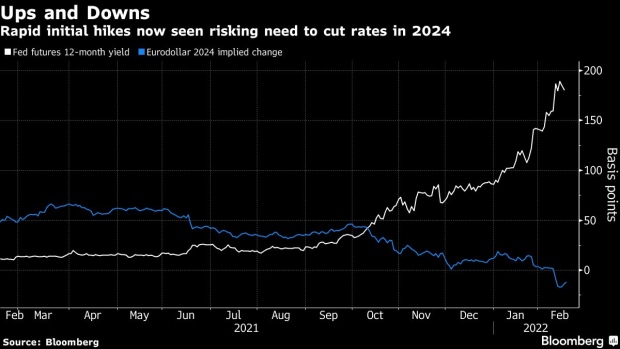

Fed Chairman Jerome Powell has pledged to rein in the strongest inflation in four decades without sparking a recession. Bond traders are signaling they expect that controlling cost pressures will require such a rapid pace of policy tightening -- six or more hikes this year -- as to make a severe slowdown in the economy all too likely. Yield curves have flattened to the narrowest levels since the pandemic hit and rates traders see strong odds the Fed will be cutting rates again in 2024.

Long-term yields this year have been rising more slowly than short-term ones. In particular, mortgage rates need to get noticeably higher, Pozsar said. The average 30-year U.S. mortgage rate climbed almost 1 percentage point this year to 4.23%, according to Bankrate.com, about half a point below its peak in 2018.

Goods prices are now a sustained source of price pressures after two decades when they were disinflationary, Pozsar said. The Fed’s new dual mandate calls for it to avoid creating recessions and yet it can only rein in goods costs through rapid interest-rate hikes to create a recession.

Policy makers would instead be best served by harnessing volatility to set off strong corrections in risk assets from stocks to credit to Bitcoin, so that workforce participation rises, according to Pozsar. His comments harked back to the way Paul Volcker broke the back of inflation in the 1980s with massive rate increases.

“If the young feeling Bitcoin-rich are less inclined to work and the old feeling mass affluent are eager to retire early, labor force participation drops to the detriment of real growth prospects,” Pozsar wrote. “Maybe the Fed should hike 50 bps in March, put an end to press conferences, and sell $50 billion of 10-year notes the next day.”

©2022 Bloomberg L.P.