Dec 22, 2023

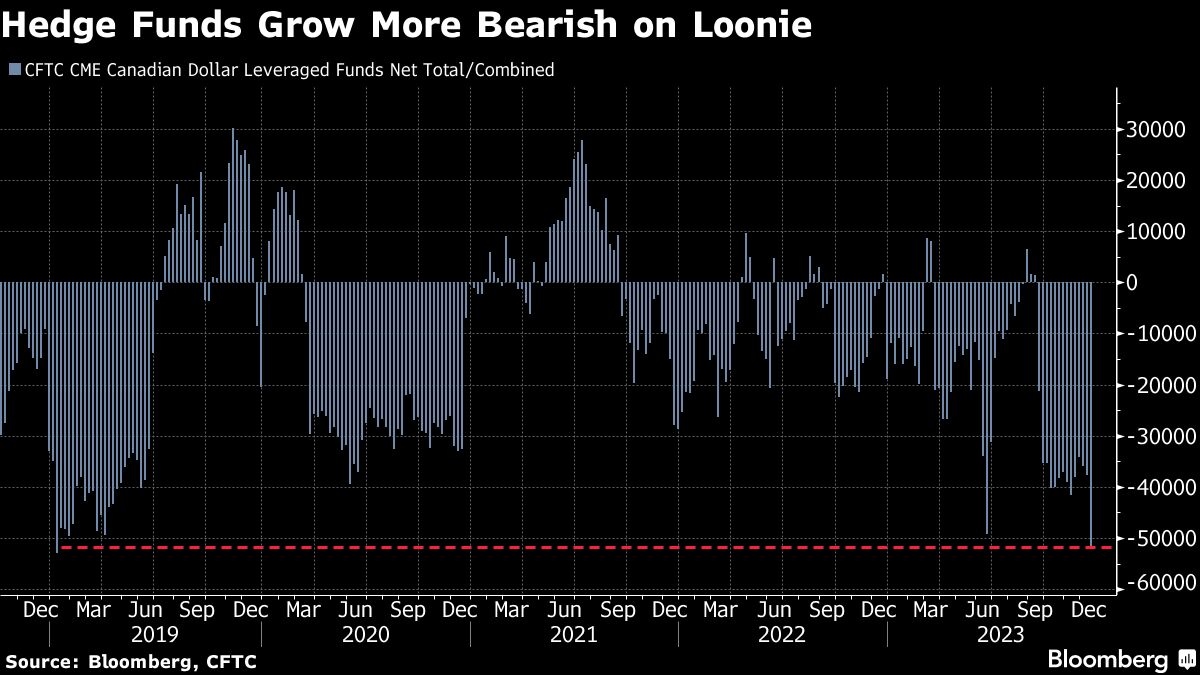

Hedge funds bet most against Canadian dollar in almost five years

, Bloomberg News

2024 Outlook for loonie & USD

Speculators are ramping up their bearish wagers on Canada’s dollar, lifting net short positions to the highest in nearly five years, according to a report from the Commodity Futures Trading Commission.

Leveraged funds boosted their wager against the loonie to 51,971 contracts in the week ended Dec. 19, the highest since January 2019 and up from 37,707 contracts the week before, according to the data.

“The Canadian dollar short base is still substantial as inflation remains stubborn and growth lackluster,” said Brad Bechtel, global head of foreign exchange at Jefferies LLC in New York. “The market has been short the pro-cyclical G-10 commodity currencies all year, including the Australian dollar, Norwegian krone and the Canadian dollar.”

The loonie has lagged its Group-of-10 peers this quarter. The Canadian economy unexpectedly shrank in the third quarter and is on track to only narrowly avoid a second straight quarter of declines. Nonetheless, Bank of Canada Governor Tiff Macklem has said policymakers still need evidence of inflation easing to start thinking about rate reductions.