Oct 15, 2018

Larry Berman: How rising bond yields could impact balanced portfolios

By Larry Berman

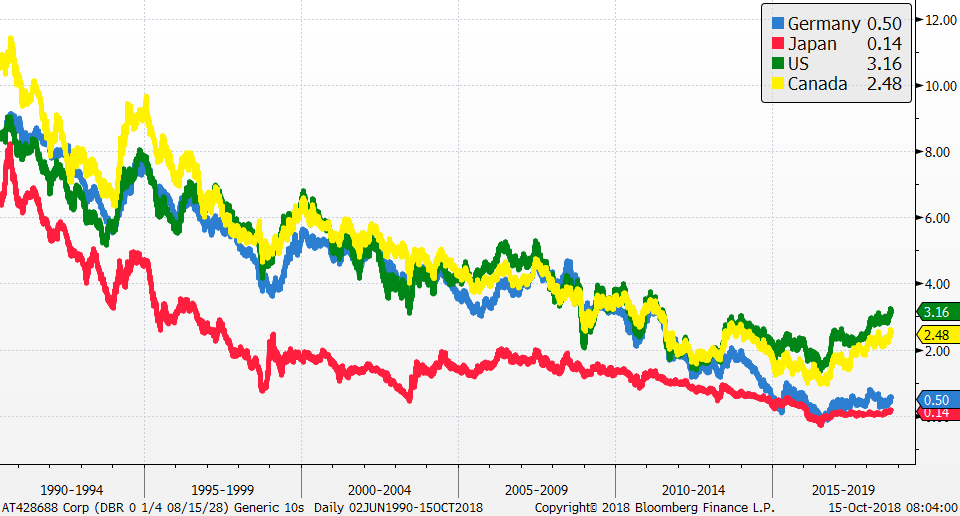

Global bond yields are moving higher, and, in some cases, breaking to levels not seen in several years.

The moves on a multi-decade scale are hardly noticeable. Japanese yields are still extraordinarily low, but are probably most important from a psychological perspective. As central banks see the need to remove liquidity from the system, this should serve to negatively impact many balanced portfolios. Toss in a revised trade deal between the U.S., Mexico, and Canada, and the potential for rates to rise in Canada are increasing a bit now too.

In Japan, that has been leading the world in quantitative easing (central bank bond purchases) and negative interest rates, we are seeing longer yields creep higher in a very controlled fashion. In Germany, that also saw negative 10-year rates in the wake of Brexit. We are seeing the European Central Bank reduce bond purchases and, in 2019, will no longer be buying bonds in the open market. When Germany takes over control of the ECB in October 2019, you can expect short-term rate to rise soon too.

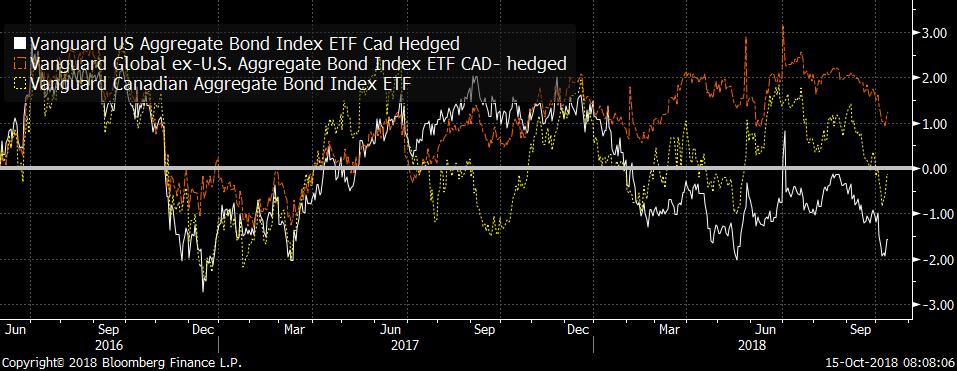

Looking at the total return of three bond ETFs (VBU – Total US, VGB – Total Global Bond, VAB – Total Canadian Bond) since the days before Brexit, we can see as rates have been rising globally, the returns from bond holdings have been poor. I would expect that for the next year or so, bond returns will be flat to negative. Recall that you are earning the yield each year, but they have been largely offset by the capital loss in bond prices as yields are rising. Bond yields have risen the most in the U.S., hence why the U.S. has seen negative returns. Canadian yields have gone up as well, but not quite as much as in the U.S., hence slightly positive returns – but certainly not good returns. And finally, internationally, returns have been a bit better, but much of that has been currency related and not from a yield or capital gains standpoint.

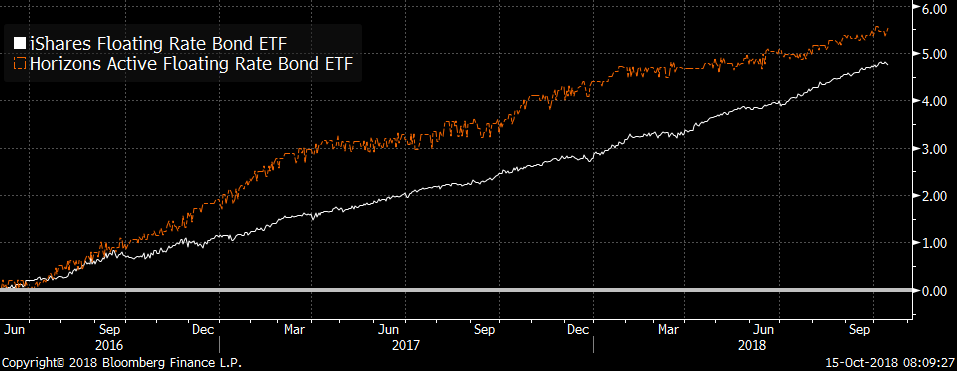

So what does an investor do when faced with a bond market that does not work to balance portfolios very well? Floating rate notes are bonds that adjust their payment based on the rising short-term rates and that serves to limit the capital loss risk that we traditionally see in bond prices as yields are rising.

The U.S. Federal Reserve told us in September that they expect to raise rates five more times through the end of 2019, and at this point, I have no reason to doubt that (current equity market volatility notwithstanding). At some point next year (around mid-year), we expect the U.S. 10-year versus two-year yield curve will invert and we will need to be concerned about a recession in 2020. Once that plays out, bond yields will head lower again. With all the debt in the world today, each economic cycle will likely see lower-yield highs and lower-yield lows. Having lots of traditional fixed income in your portfolios may not give you the balance that you would have historically enjoyed over the next year.

Our fall roadshow dates are out. Come out and find out How to profit while protecting in the longest bull market of all-time where I will look at some of my top sector ETF picks for the next few years and teach you how to build balanced portfolios that will work better in the next few years. Register free at www.etfcm.com and as always we ask for volunteer donations to one of our two favourite charities. Children’s cancer research at the Sick Kids Hospital and Alzheimer’s and dementia research at the Baycrest Hospital.

| City | Date |

|---|---|

| Edmonton | Wednesday Oct.17, 2018 |

| Calgary | Saturday Oct. 20, 2018 |

| Regina | Wednesday Oct. 24, 2018 |

| Winnipeg | Thursday Oct. 25, 2018 |

| Toronto - Etobicoke | Saturday Nov. 3, 2018 |

| Halifax | Wednesday Nov. 7, 2018 |

| Montreal - Laval | Thursday Nov. 8, 2018 |

| Ottawa | Saturday Nov. 10, 2018 |

| London | Tuesday Nov. 13, 2018 |

| Toronto - Markham | Saturday Nov. 24, 2018 |

| Victoria | Wednesday Nov. 28, 2018 |

| Vancouver | Saturday Dec.1, 2018 |

Follow Larry Online:

Twitter: @LarryBermanETF

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com