Apr 20, 2022

Most stocks gain in seesaw session as bonds rally

, Bloomberg News

BNN Bloomberg's closing bell update: April 20, 2022

Most U.S. stocks rose with earnings in focus, while Treasuries rallied as a growing chorus of money managers said inflation is nearing a peak and rate-hike bets are overdone.

After a roller-coaster session, the S&P 500 ended little changed with nine of 11 industry groups advancing. Procter & Gamble Co. and International Business Machines Corp. climbed after reporting better-than-estimated results.

Meanwhile, the tech-heavy Nasdaq 100 stumbled, with Netflix Inc. sinking more than 30 per cent after reporting its first subscriber decline in more than a decade. That also weighed on other streaming and media companies such as Walt Disney Co., Warner Bros. Discovery Inc. and Paramount Global. Tesla Inc. declined before reporting earnings.

Ten-year yields in Treasuries shed 7 basis points as Bank of America Corp. to Nomura Asset Management saw buying opportunities in bonds. Bank of America said it has turned long on 10-year securities.

“There’s a feeling that markets are focused on the idea that inflation is expected to peak this quarter and that means that we might be expecting that this is going to be as bad as it gets,” Fiona Cincotta, senior market analyst at City Index, said by phone. “So those bets on really aggressive rate hikes from the Fed might have been a little bit overdone here.”

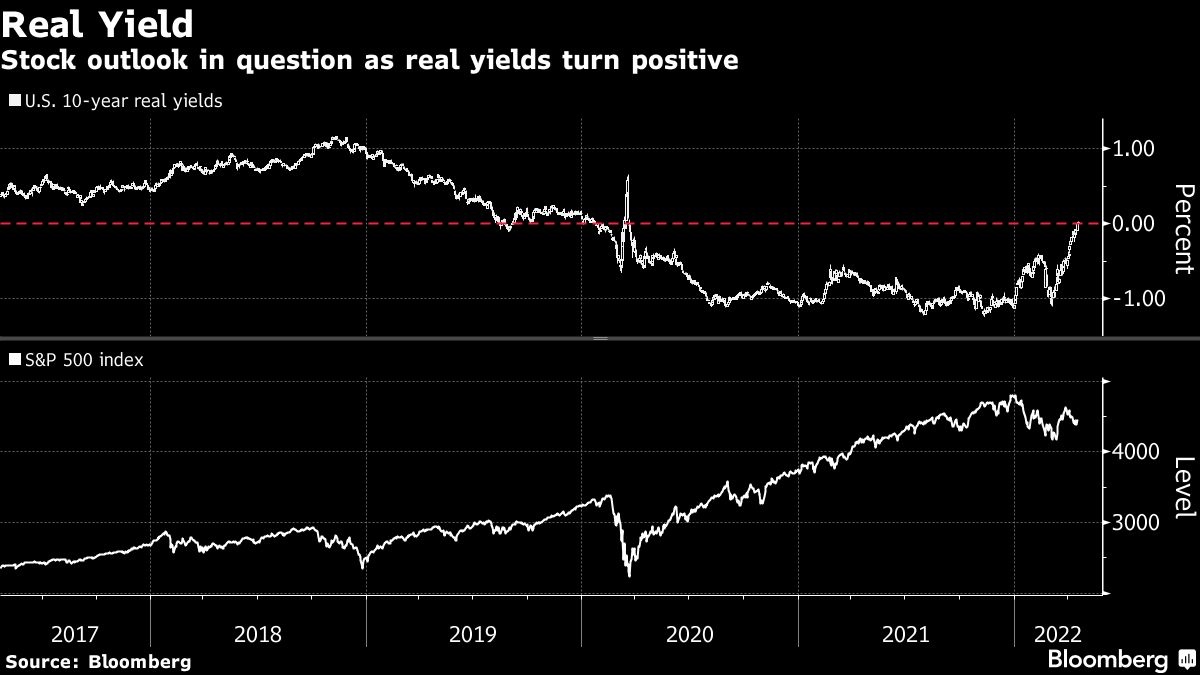

U.S. 10-year real yields turned positive for the first time since March 2020, signaling a potential return to the pre-pandemic normal. But that was quickly followed by a global drop in bond yields as investors assessed growth challenges from the Ukraine war and the potential for a peak in inflation.

Short-term interest-rate traders pushed the market-implied odds that the Federal Reserve will raise rates in half-point increments in both May and June to 100 per cent earlier on Wednesday.

The yen rose as much as 1 per cent versus the dollar on Wednesday, but remained the weakest performer in the Group of 10 this year on the policy contrast with the U.S.: the Bank of Japan offered to buy an unlimited amount of bonds to contain yields, underscoring its desire for loose monetary settings.

More market commentary

- Netflix’s slump may not drag down the entire tech sector, “but certainly enough of it to cause all of the Nasdaq to bleed while value indices are buoyant,” said Max Gokhman, chief investment officer for AlphaTrAI. “This is the second horseman of the apocalypse for consumer tech, with the first being FB’s massive drop after their Q4 earnings.”

- “As I look through the earnings numbers that are coming in and the commentary that’s coming in, I still see evidence of a very healthy consumer, of an economy that is not cracking,” Lori Calvasina, head of U.S. equity strategy at RBC Capital Markets, said on Bloomberg TV. “We have some concentrated pockets of risk to navigate around. But the market deserves to be where it is right now.”

What to watch this week:

- Earnings include American Express, China Telecom, Tesla

- EIA crude oil inventory report, Wednesday

- Federal Reserve Beige Book, Wednesday

- French presidential election debate, Wednesday

- Euro zone CPI, U.S. initial jobless claims, Thursday

- Fed Chair Jerome Powell, ECB President Christine Lagarde discuss global economy at IMF event, Thursday

- Manufacturing PMIs: Euro zone, France, Germany, U.K, Friday

- Bank of England’s Andrew Bailey to speak, Friday

Some of the main moves in markets:

Stocks

- The S&P 500 was little changed as of 4 p.m. New York time

- The Nasdaq 100 fell 1.5 per cent

- The Dow Jones Industrial Average rose 0.7 per cent

- The MSCI World index rose 0.3 per cent

Currencies

- The Bloomberg Dollar Spot Index fell 0.6 per cent

- The euro rose 0.6 per cent to US$1.0853

- The British pound rose 0.5 per cent to US$1.3062

- The Japanese yen rose 0.9 per cent to 127.74 per dollar

Bonds

- The yield on 10-year Treasuries declined 10 basis points to 2.84 per cent

- Germany’s 10-year yield declined five basis points to 0.86 per cent

- Britain’s 10-year yield declined five basis points to 1.92 per cent

Commodities

- West Texas Intermediate crude rose 0.2 per cent to US$102.75 a barrel

- Gold futures were little changed