Jul 20, 2023

Oil holds near US$80 as U.S. stockpile drop offsets demand worries

, Bloomberg News

Buy copper below US$3.70 before Chinese stimulus & energy transition push prices higher: Strategist

Oil steadied near US$80 a barrel in London as traders assessed a mixed picture in the U.S. market and China’s efforts to revitalize its sagging economic growth.

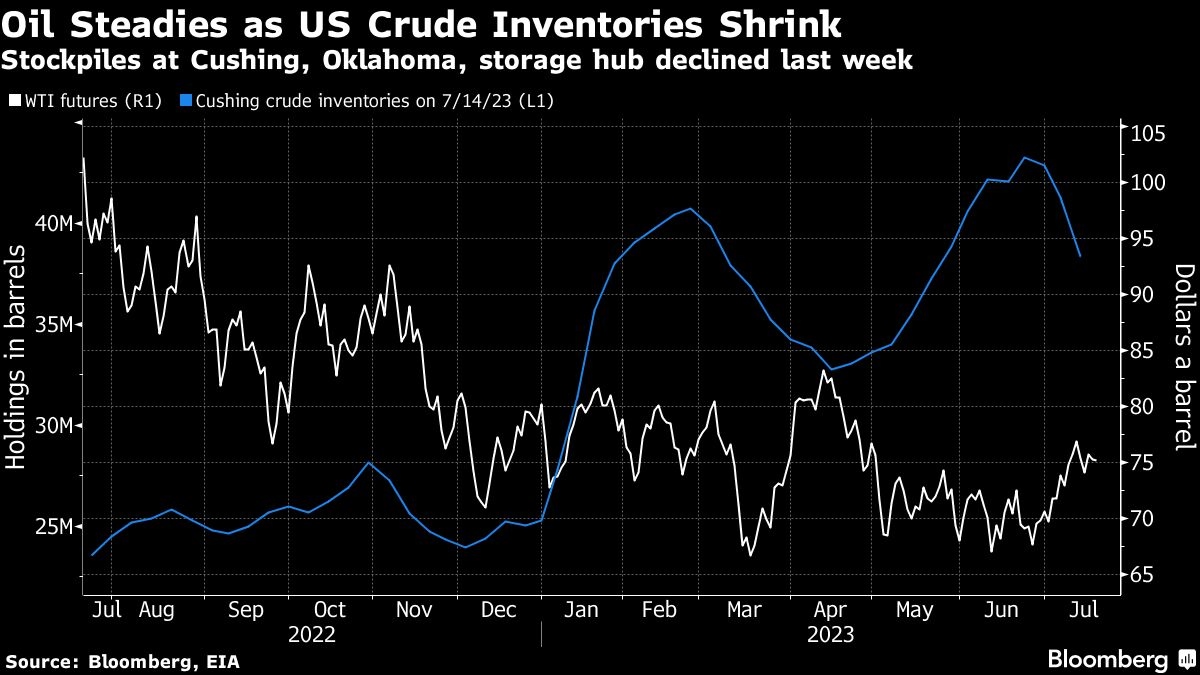

Brent futures were slightly higher on Thursday in thin trading volumes typical for this time of year. U.S. data showed crude inventories at the nation’s storage hub in Cushing, Oklahoma, shrank last week by the most since October 2021. However, that was tempered by a second weekly drop in demand for the main refined products: gasoline, distillates and jet fuel.

Crude has traded in a narrow range this week, and is still marginally down this year, after making a sharp break higher since late June on signs the market may finally be tightening.

“Brent is clearly finding it difficult to convincingly break above US$80 a barrel,” said Warren Patterson, head of commodities strategy at ING Groep NV.

China’s efforts to revive growth, ranging from lower interest rates, easier access to credit and a series of measures to kick-start the moribund housing market have done little to bolster the economy of the biggest crude importer. Another signal that Beijing was seeking to boost corporate confidence came this week, with a joint pledge by the Communist Party and the government to improve conditions for private businesses.

The recent revival in the U.S. dollar, following a slump last week, added to the bearishness for oil, with commodities priced in the currency more expensive for most buyers.

Prices:

- WTI for August delivery, which expires Thursday, added 0.3 per cent to US$75.56 a barrel at 10:26 a.m. in London.

- The more-active September contract rose 0.2 per cent.

- Brent for September settlement gained 0.1 per cent to US$79.57 a barrel.