Apr 16, 2024

Philippines-China Tensions Hitting Peso, Central Bank Chief Says

, Bloomberg News

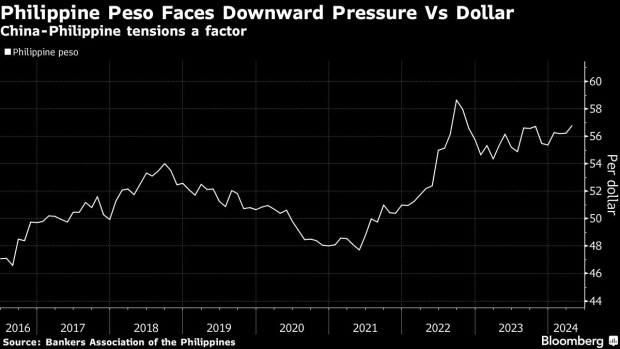

(Bloomberg) -- Tensions between the Philippines and China over competing maritime claims have added to pressures on the peso that has slumped to a seven-month low, and “an escalation would be a big concern” for investors, according to the Southeast Asian nation’s central bank chief.

“There’s a risk whenever there’s an incident in the Philippine sea, the peso depreciates a bit,” Bangko Sentral ng Pilipinas Governor Eli Remolona said in an interview on Monday, in possibly the first official confirmation that the escalating South China Sea dispute is already manifesting in the markets.

“A few of the episodes of peso weakness came right after” incidents in the disputed waters, Remolona said. The BSP had been looking at the correlation between the currency and the sea spat over the past year and noticed a mild negative impact on the peso during encounters between Philippine and Chinese vessels, he said. Much of the pressure is due to a strong dollar, he added.

The peso touched a two-month low against the dollar on March 25 after a weekend clash between Philippine and Chinese ships where a Filipino boat was damaged and some of its crew members were injured when two Chinese Coast Guard ships fired water cannons at it.

The currency has since weakened further against the dollar, trading at as low as 56.99 on Tuesday, slipping along with most Asian currencies.

Still, Remolona said the central bank has hardly intervened in the currency market in recent weeks and that he’s comfortable with current levels.

“If the peso is weakening along with other currencies, then we don’t really try to intervene,” he added.

The central bank’s intervention strategies have changed, Remolona said, after it spent billions of dollars from its reserves when the peso plunged to a record low of 59 against the dollar in September-October 2022.

When asked about the BSP’s support level for the peso, Remolona said “there are support levels, and there are support levels.”

He described 57 as a “weak support level,” meaning it’s not a key level that authorities are looking at.

--With assistance from Ditas Lopez.

©2024 Bloomberg L.P.