Sep 12, 2022

Stock Options Tape Sprinkled With Bullish Bets in Big Money FOMO

, Bloomberg News

(Bloomberg) -- Skittish investors caught leaning by the latest equity bounce are flocking to the options market as a quick way to play catch-up.

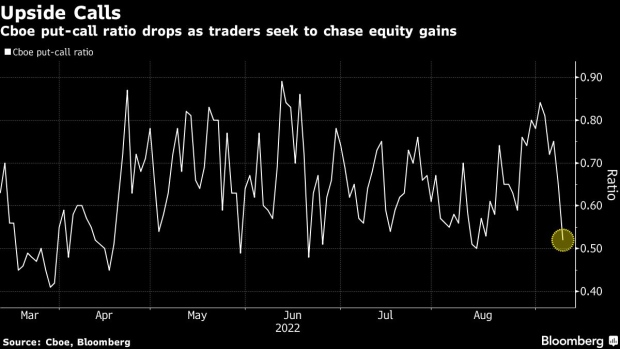

In one talked-about trade Monday, someone spent about $80 million on call options wagering that the S&P 500 would rally to 4,300 by December, according to Piper Sandler & Co. That followed a flurry of buying on Friday that sent the Cboe equity put-call ratio to the biggest drop since July.

The taste for bullish bets is a reversal from late August, when a three-week slump sent traders into put options. While skeptics warn the bounce is just a short squeeze, it puts pressure on investors, especially those whose annual report cards are due in coming months.

There were “several examples of investors turning to upside calls for exposure to (or protection against) further momentum, both outright and versus downside put sales,” Christopher Jacobson, a strategist at Susquehanna Financial Group, wrote in a note. “They could certainly be driven by investors who are underweight looking to these upside calls for limited-risk exposure.”

Among Friday’s bullish trades in the options market flagged by Susquehanna was one that paid 53 cents each for 30,000 calls betting the iShares Russell 2000 ETF (ticker IWM) would rise to $199 by month-end -- a wager that would break even if the ETF rises 6.6% by expiration. Another involved paying about $2.65 for roughly 15,000 calls linked to the SPDR S&P Biotech ETF (ticker XBI) with a strike price at $100 expiring in November. That trade would make money should the fund jump more than 16% over the next two months, Jacobson noted

While there are always traders buying calls or selling puts somewhere on any given day, the aggregate data from Cboe showed a clear pivot toward a bullish stance. The equity put-call ratio dropped to 0.52 on Friday, down from a high of 0.84 at the start of this month.

Read more: Forced Buying Puts a Floor Under Stocks Nobody Else Wants to Own

Fear of missing out is suddenly back in vogue after investors from day traders and professional speculators turned sour on equities. While risk appetite remained subdued amid mounting risk from raging inflation to war and a hawkish Federal Reserve, the urge to chase gains is creeping up.

During the week through Thursday, hedge funds tracked by Goldman Sachs Group Inc. bought shares for the first time in a month, with the notional long buying reaching a one-year high, data from the firm’s prime broker show.

As stocks climbed Monday for a fourth straight session, Danny Kirsch, head of options at Piper Sandler, noticed a rather large derivatives trade coinciding with the initial rally. One trader paid $90 each for 9,000 S&P 500 calls with a strike price of 4,300 by December. The trade would be profitable if the index closes above 4,390 at expiry, he estimates. The benchmark gauge ended Monday at 4,110.41.

“It’s very big size,” said Kirsch. “Maybe someone is under-invested or just bullish looking to play for year-end rally.”

©2022 Bloomberg L.P.