May 3, 2022

Tech Billionaire Sets Up AGL Climate Showdown in Australia

, Bloomberg News

(Bloomberg) --

Billionaire Mike Cannon-Brookes is urging AGL Energy Ltd. shareholders to reject plans to separate the utility’s coal plants into a new company, setting up a showdown over the speed of Australia’s transition to clean power.

The Atlassian Corp. founder will open talks with other investors in the coming days after his personal office Grok Ventures became the utility’s largest shareholder by acquiring a A$650 million ($460 million) stake. Investors will be asked to vote next month on a plan to divide the company’s retail and power generation assets.

“It’s almost like a white flag is the only option: take the bad stuff, shove it in a corner and pretend it doesn’t exist,” Cannon-Brookes said Tuesday in an interview. “In reality you haven’t solved or changed anything.”

AGL, formed in 1837, previously rejected takeover approaches earlier this year from a consortium including Cannon-Brookes and led by Brookfield Asset Management Inc. The partners had aimed to close down the firm’s fossil fuel assets faster and hit a net-zero target about a decade earlier than current plans.

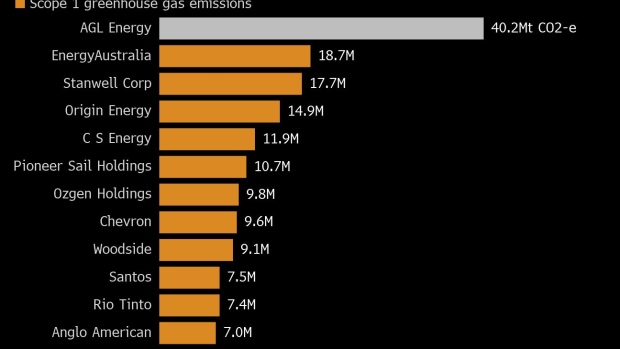

The company’s proposal to divide its retail and power generation assets will destroy value, leave the coal-power unit Accel Energy exposed to stranded asset risks and does too little to accelerate efforts to reduce AGL’s climate footprint, according to Cannon-Brookes. AGL is Australia’s largest emitter of scope-one greenhouse gases.

Instead, the firm should remain as a single entity, make a faster switch from coal to renewable energy generation, and prepare for rising energy demand -- and higher profitability -- delivered by decarbonization and the growth in electric vehicles, he said.

“The company doesn’t get any better when you separate it in half,” Cannon-Brookes said. “The total number of carbon emissions doesn’t change the day after it’s demerged one iota.”

AGL’s shares fell 3.1% in Sydney trading Tuesday.

The utility’s management has not yet spoken to Cannon-Brookes or Grok Ventures following his decision to acquire an 11% stake, and rejects his analysis of the firm’s strategy, AGL’s Chief Executive Officer Graeme Hunt said in an interview.

“What appears to be proposed by Cannon-Brookes does not protect shareholder value and does not protect customers,” Hunt said. The investor “has an objective for the company, but he does not have a plan.”

Sydney-based AGL has repeatedly stressed the need for a steady transition to cleaner energy, arguing that closing coal operations earlier without adequate replacement capacity would risk higher bills for consumers.

The firm’s pact with Global Infrastructure Partners to become a 49% partner in a new A$2 billion investment vehicle is evidence that Accel Energy will have access to funding to transition to low-carbon operations, Hunt said.

Health Employees Superannuation Trust Australia, a A$68 billion pension fund which holds AGL shares, said it also had concerns over the company’s plans. The fund “is unlikely to support the demerger unless we see a clear strategy to invest in renewables and storage, and strong commitments to close coal-fired power plants earlier than currently proposed,” CEO Debby Blakey said in a statement.

AGL’s existing management team would need to consider their positions if investors reject the demerger in a scheduled June 15 vote, according to Cannon-Brookes.

“I think they’re nailing their colors to the flag,” he said. “It would be presumably very challenging for some significant number of those people to stay around should it get voted down, because this is the only option and the only belief they have for the future of the company.”

©2022 Bloomberg L.P.