Sep 29, 2022

Things Keep Getting Worse for Hong Kong’s Embattled Stock Market

, Bloomberg News

(Bloomberg) -- Hong Kong stock traders just can’t catch a break from bad news.

Thursday saw a disastrous trading debut of a Chinese electric-vehicle maker that was one of worst in the city. A slump in China tech stocks added to the woes, with a gauge closing near the lowest since inception two years ago.

That came after the financial hub’s stock benchmark Hang Seng Index sank to the lowest in over a decade last week and a measure of Chinese stocks listed in Hong Kong plunged to the weakest since the global financial crisis. The two indexes rank as the worst performing among major equity benchmarks globally this month.

The selloff was part of a global rout as central bankers are determined to raise rates further to squash inflation, raising fears of a recession. In Hong Kong, stocks -- many of which are from mainland firms -- have been battered particularly hard as hostility grows between Beijing and Washington over Taiwan, Chinese firms’ listing status in the US remains uncertain, and Xi Jinping sticks to the Covid Zero policy.

“I don’t remember when was the last time for us to see so much bad news at the same time,” said Kenny Wen, head of investment research at KGI Asia Ltd. “The Hong Kong market is facing a weak Chinese econony, global energy crisis, the never-ending war between Russia and Ukraine, and an inflation nightmare.”

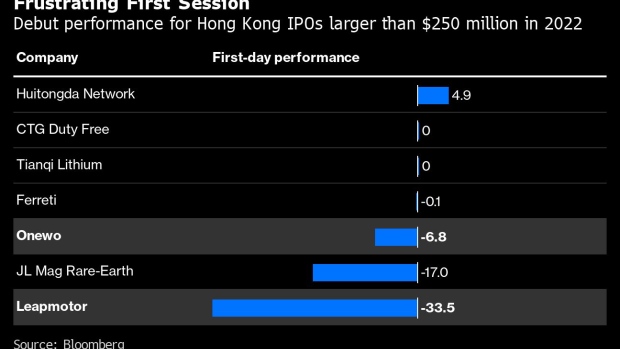

EV maker Zhejiang Leapmotor Technology ended down 34% after raising about $800 million in an initial public offering. The slide capped the biggest first-day decline for a listing of that size or bigger on record in Hong Kong. Onewo Inc., China Vanke’s property management unit, also finished its first trading session 6.8% lower. The firm garnered about $740 million.

The Chinese companies debuted in what’s been a tough year for IPO performance and equity markets in general. Before Thursday, half of the 16 firms that listed in Hong Kong this year following IPOs that raised over $100 million ended their first session below water, Bloomberg-compiled data show.

Some traders are pinning their hopes on China’s twice-a-decade Party congress next month for a revival of the nation’s shares.

A key strategy is to bet on more policy support for the property market as Beijing seeks to rescue the ailing industry. In fact, authorities have already been rolling out measures with its central bank on Thursday vowing to expand a special lending program to ensure the delivery of delayed housing projects. Barclays Plc. estimates China’s fiscal stimulus this year now tops the amount issued in 2020.

Still, traders are having a hard time feeling optimistic with China’s housing market, which accounts for a quarter of the nation’s economic output, showing little sign of a turnaround.

“I’m not going to recommend buying any stock at the moment,” Wen of KGI Asia said. “There might be a very short-term technical rebound, but in the mid-term, I’m still very bearish.”

©2022 Bloomberg L.P.